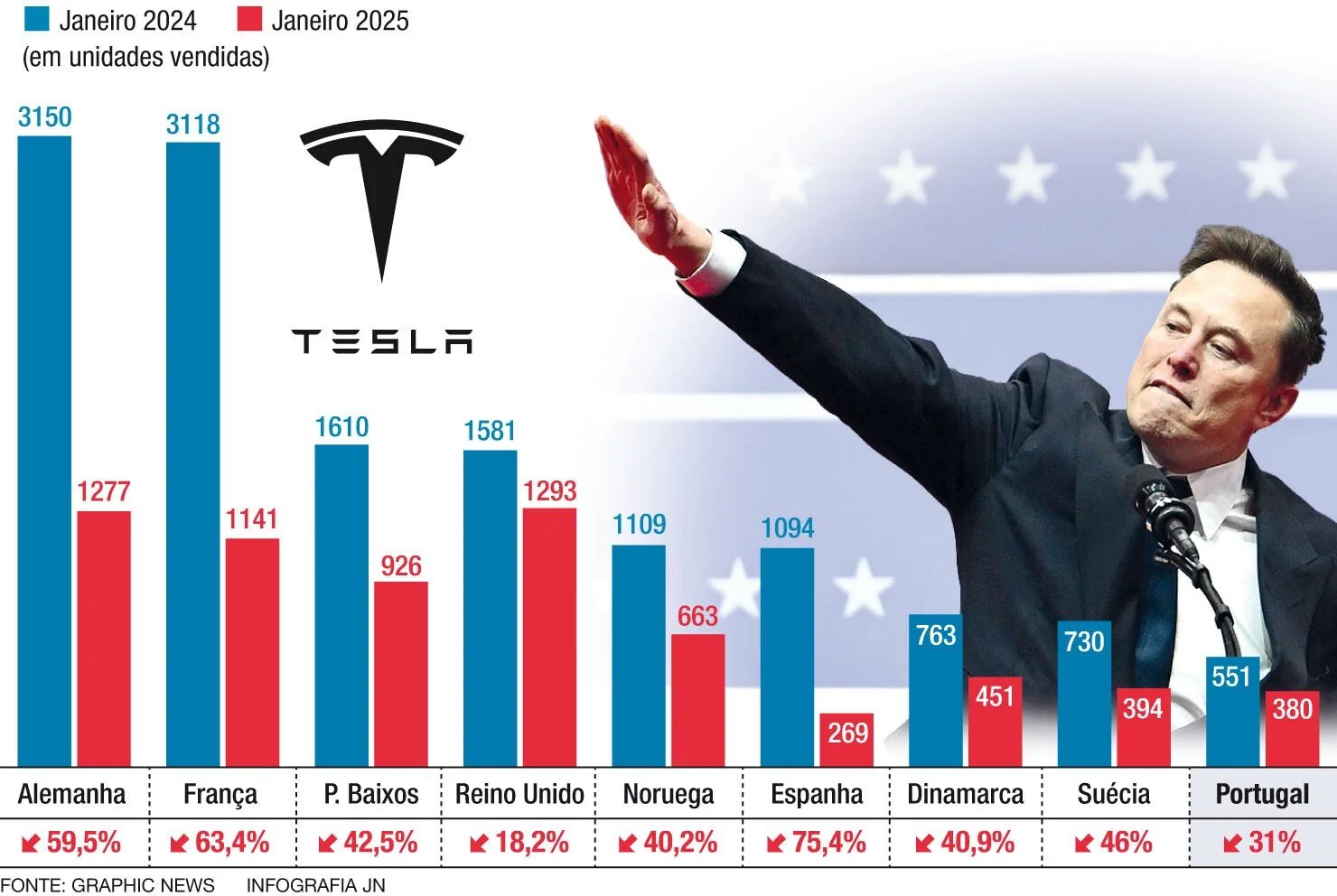

The electric vehicle (EV) market in Europe has long been a stronghold for Tesla, the trailblazer of the EV revolution. However, recent data reveals a startling decline: Tesla sales in Europe have plummeted by 45% compared to the same period last year. This dramatic drop comes as rivals ramp up their efforts, flooding the market with competitive models that are capturing consumer attention. What’s behind this seismic shift, and what does it mean for Tesla’s dominance in one of the world’s most critical EV markets? Let’s explore the factors driving this change and what lies ahead for the automaker.

### **Tesla’s Decline in Europe**

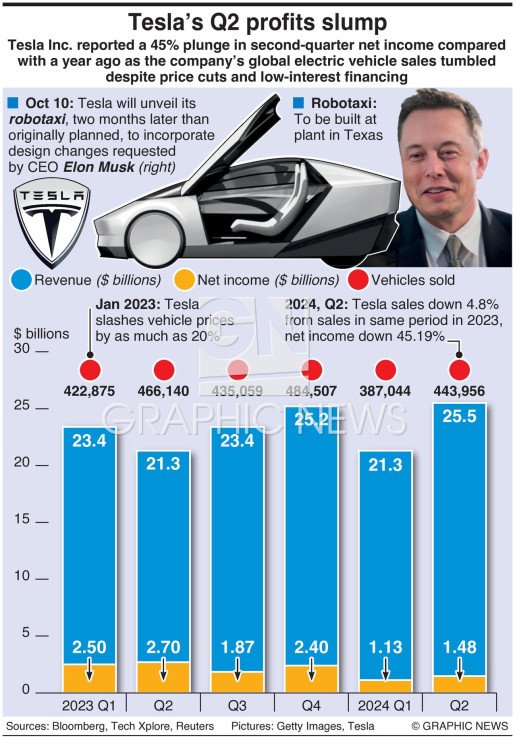

According to industry reports, Tesla’s sales figures in Europe have taken a significant hit, with registrations dropping by 45% year-over-year. This decline is particularly striking given the overall growth of the EV market on the continent. In fact, EV registrations across Europe have surged, driven by government incentives, stricter emissions regulations, and increasing consumer demand for sustainable transportation options. Yet, Tesla’s share of this expanding pie is shrinking—a worrying sign for a company once seen as untouchable.

For context, Tesla accounted for nearly 80% of the European EV market just a few years ago. Today, that figure has dwindled to less than 20%. While the company still commands respect and brand loyalty, its inability to maintain market leadership raises questions about its strategy and adaptability in an increasingly crowded and competitive landscape.

### **The New Faces of Europe’s EV Boom**

One of the primary reasons for Tesla’s declining sales in Europe is the rapid emergence of formidable competitors. Established automakers like Volkswagen, BMW, Mercedes-Benz, and Hyundai have made massive investments in electrification, rolling out sleek, feature-rich EVs tailored to European tastes. These brands bring decades of manufacturing expertise, extensive dealership networks, and deep pockets to the table—advantages that Tesla struggles to match in certain areas.

For instance, Volkswagen’s ID. series has become a favorite among European buyers, offering affordable yet stylish alternatives to Tesla’s Model 3 and Model Y. Similarly, Hyundai’s Ioniq lineup and Kia’s EV6 have garnered rave reviews for their cutting-edge technology and impressive range capabilities. Even luxury players like Porsche and Audi are carving out niches with high-performance EVs that appeal to affluent consumers.

Moreover, Chinese automakers such as BYD and NIO are beginning to make inroads into the European market, leveraging aggressive pricing strategies and innovative designs. Their entry adds another layer of complexity to Tesla’s challenge, further fragmenting the market and diluting Tesla’s once-unrivaled appeal.

### **A Growing Disconnect**

Another factor contributing to Tesla’s struggles in Europe is its failure to fully align with local preferences and practicalities. European drivers often prioritize compact, efficient vehicles suited for urban environments and narrow roads. Many of Tesla’s models, while technologically advanced, tend to be larger and more expensive than what the average European buyer seeks.

Additionally, charging infrastructure remains a sticking point. While Tesla boasts its proprietary Supercharger network, many European consumers prefer cars compatible with widely available public chargers. Competitors’ EVs, which support universal standards like CCS (Combined Charging System), offer greater flexibility in this regard.

Furthermore, European governments heavily subsidize smaller, locally produced EVs, making them more attractive to budget-conscious buyers. Tesla’s premium pricing puts it at a disadvantage in this subsidy-driven market, where affordability plays a key role in purchasing decisions.

### **Supply Chain Woes and Production Challenges**

Tesla’s struggles aren’t solely due to external competition; internal challenges have also played a part. Supply chain disruptions caused by global events, including the COVID-19 pandemic and geopolitical tensions, have impacted production timelines and delivery schedules. For a company known for its ambitious targets, delays can erode customer trust and push buyers toward competitors who can deliver faster.

Moreover, Tesla’s reliance on centralized manufacturing hubs—such as its Gigafactory in Germany—has created logistical bottlenecks. Unlike traditional automakers with multiple regional plants, Tesla’s supply chain vulnerabilities leave it exposed to localized disruptions. This issue becomes especially pronounced in Europe, where proximity to production facilities often influences purchasing behavior.

### **Marketing and Brand Perception: Losing the Edge**

Tesla’s minimalist marketing approach, which relies heavily on word-of-mouth and online buzz rather than traditional advertising, may also be working against it in Europe. While this strategy succeeded in the early days when Tesla was the only game in town, it now faces fierce competition from brands investing heavily in targeted campaigns and brand-building initiatives.

Additionally, Tesla’s reputation has taken some hits recently due to controversies surrounding CEO Elon Musk’s public statements, workplace conditions, and quality control issues. These factors, combined with growing concerns about over-the-air software updates causing temporary glitches, have dented consumer confidence in the brand.

In contrast, European automakers are doubling down on trust-building measures, emphasizing reliability, craftsmanship, and customer service. For many buyers, these attributes outweigh Tesla’s tech-forward image, leading them to choose alternatives they perceive as safer bets.

### **What Does This Mean for Tesla’s Future in Europe?**

Despite its current setbacks, Tesla isn’t out of the race just yet. The company retains several strengths that could help it regain lost ground:

**Brand Loyalty** : Tesla still enjoys a loyal fanbase that values its cutting-edge technology, autonomous driving features, and environmental mission.

**Gigafactory Expansion** : With its Gigafactory Berlin ramping up production, Tesla aims to reduce costs and improve delivery times for European customers.

**Upcoming Models** : Rumors of new, more affordable Tesla models designed specifically for mass-market appeal could reinvigorate interest among price-sensitive buyers.

**Software Leadership** : Tesla’s unparalleled software ecosystem, including Full Self-Driving (FSD) capabilities, remains a unique selling point that competitors struggle to replicate.

However, regaining market share will require Tesla to address its weaknesses head-on. This includes adapting to local preferences, enhancing customer relations, and ensuring consistent quality across its product lineup.

### **Broader Implications for the EV Market**

Tesla’s struggles highlight the evolving dynamics of the global EV market. As competition intensifies, no single player can afford to rest on its laurels. Automakers must continuously innovate, adapt to regional demands, and invest in sustainable practices to stay relevant.

For Europe, this shift represents an opportunity to diversify its EV offerings and reduce dependence on any one manufacturer. It also underscores the importance of fostering a robust charging infrastructure and supportive policies to encourage widespread EV adoption.

Ultimately, Tesla’s experience serves as a cautionary tale for other automakers: success today doesn’t guarantee dominance tomorrow. Staying ahead requires agility, foresight, and an unwavering focus on meeting customer needs.

### **A Turning Point for Tesla and the EV Industry**

Tesla’s 45% sales drop in Europe marks a pivotal moment—not just for the company but for the entire EV industry. The rise of strong competitors, shifting consumer preferences, and operational challenges have exposed vulnerabilities in Tesla’s armor. Yet, history shows that Tesla thrives under pressure, often emerging stronger after periods of adversity.

As the battle for Europe’s EV market heats up, all eyes will be on how Tesla responds. Will it adapt and reclaim its throne, or will it continue to lose ground to hungry rivals? One thing is certain: the outcome will shape the future of mobility in Europe and beyond.

For now, the message is clear: complacency has no place in the fast-evolving world of electric vehicles. Whether you’re rooting for Tesla or cheering on its competitors, the next chapter promises to be nothing short of electrifying.