In recent years, the relationship between the United States and China has been a focal point of global geopolitical discussions. Among the many contentious issues, former President Donald Trump’s controversial statement about imposing a 10% tax on Chinese imports stands out as a potential game-changer—or what he might call his “trump card.” This article delves into the implications of such a policy, its potential impact on US-China relations, and the broader economic consequences for both nations and the world.

### **The Context Behind Trump’s Proposal**

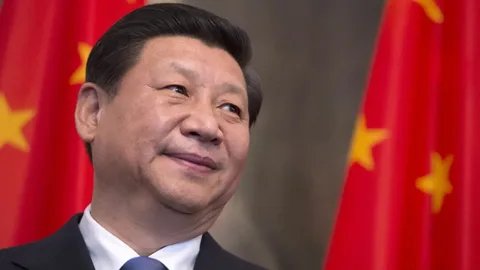

Donald Trump has long been known for his unconventional approach to international trade and diplomacy. During his presidency, he championed an “America First” policy that sought to reduce trade deficits, protect domestic industries, and renegotiate agreements perceived as unfavorable to the U.S. One of his most significant moves was initiating a trade war with China by imposing tariffs on billions of dollars worth of Chinese goods.

Now, even after leaving office, Trump continues to advocate for tough measures against China. His latest proposal—a blanket 10% tax on all Chinese imports—is seen as a continuation of this strategy. According to Trump, this tax would serve multiple purposes: leveling the playing field for American businesses, generating revenue for the U.S. government, and exerting pressure on China to address longstanding trade imbalances and intellectual property concerns.

While some view this proposal as bold and necessary, others criticize it as overly aggressive and potentially damaging to the global economy. To fully understand its significance, we must examine the motivations behind Trump’s stance and how it fits into the broader narrative of U.S.-China relations.

### **The Potential Impact on U.S.-China Trade Dynamics**

If implemented, a 10% tax on Chinese imports could have far-reaching effects on the already strained relationship between Washington and Beijing. For decades, China has been one of the largest trading partners of the United States, exporting everything from electronics to textiles. A uniform tariff increase would undoubtedly disrupt supply chains, raise costs for American consumers, and create uncertainty for businesses operating in both countries.

#### **Economic Implications for the U.S.**

On the surface, the proposed tax appears to benefit the U.S. economy by encouraging domestic production and reducing reliance on foreign imports. However, critics argue that it could backfire. Higher tariffs often lead to increased prices for everyday goods, disproportionately affecting low- and middle-income households. Additionally, American companies reliant on Chinese components or raw materials may face higher operational costs, which could stifle innovation and competitiveness.

Moreover, retaliatory actions from China are almost guaranteed. In the past, Beijing has responded to U.S. tariffs with countermeasures such as imposing duties on American agricultural products and restricting access to its vast consumer market. Such tit-for-tat exchanges could escalate tensions further, creating a lose-lose scenario for both economies.

#### **Challenges for China**

For China, the imposition of a 10% tax represents yet another hurdle in its efforts to maintain steady growth amidst internal challenges like demographic shifts and slowing industrial output. While the country has diversified its export markets in recent years, losing access to the lucrative U.S. market would still deal a significant blow to its manufacturing sector.

However, China is unlikely to take these developments lying down. The Chinese government has historically used state-controlled media to rally public sentiment against perceived Western aggression, framing U.S. policies as unfair and imperialistic. Furthermore, Beijing may accelerate its push for self-reliance through initiatives like “Made in China 2025,” aiming to reduce dependence on foreign technology and bolster domestic industries.

### **A ‘Trump Card’ or a Risky Gamble?**

The term “trump card” refers to a decisive move or advantage held in reserve until the right moment. In this context, Trump seems to believe that applying a 10% tax on Chinese imports will give the U.S. leverage in negotiations with Beijing. By targeting China’s exports—the backbone of its economy—Trump aims to force concessions on issues ranging from trade practices to human rights.

But is this strategy truly a winning hand, or does it carry too many risks? Proponents argue that the U.S. holds considerable sway due to its status as the world’s largest economy and consumer market. They contend that China cannot afford to lose access to American buyers, especially at a time when its own economy is under strain.

Critics, however, warn that such brinkmanship could spiral out of control. A full-blown trade war would not only harm the U.S. and China but also destabilize global markets, disrupt international supply chains, and hinder cooperation on critical issues like climate change and pandemics. Moreover, alienating China could drive it closer to other adversaries of the U.S., such as Russia, thereby complicating the geopolitical landscape.

### **Global Ramifications Beyond Bilateral Tensions**

The ripple effects of a 10% tax on Chinese imports extend beyond the U.S. and China. In today’s interconnected world, no nation operates in isolation. Countries across Asia, Europe, and Latin America rely heavily on trade with both superpowers, meaning any escalation in their dispute could reverberate globally.

#### **Impact on Developing Economies**

Developing nations, in particular, stand to suffer if U.S.-China tensions worsen. Many of these countries depend on exports to either the U.S. or China, and disruptions in demand could derail their economic progress. For example, Southeast Asian nations like Vietnam and Indonesia have benefited from the U.S.-China trade war by attracting redirected investments and manufacturing activities. However, prolonged instability could undermine investor confidence and slow regional growth.

#### **Supply Chain Disruptions**

Another major concern is the potential disruption of global supply chains. China remains a key player in producing essential goods, including semiconductors, pharmaceuticals, and consumer electronics. A sudden spike in tariffs could force multinational corporations to relocate operations elsewhere, leading to temporary shortages and price hikes worldwide.

#### **Environmental and Social Costs**

Lastly, there are environmental and social dimensions to consider. Trade wars often incentivize countries to prioritize short-term gains over sustainable development. For instance, relaxing environmental regulations to attract investment or cutting labor protections to remain competitive can exacerbate inequality and ecological degradation.

### **Is There a Middle Ground?**

While Trump’s proposal reflects a hardline stance, many experts advocate for more nuanced approaches to addressing U.S.-China tensions. Diplomacy, rather than confrontation, could pave the way for mutually beneficial outcomes. Some suggestions include:

1. **Bilateral Agreements:** Negotiating specific deals to resolve trade disputes without resorting to blanket tariffs.

2. **Multilateral Cooperation:** Engaging allies and international organizations to mediate conflicts and establish fairer trade rules.

3. **Focus on Innovation:** Investing in research and development to enhance U.S. competitiveness instead of relying solely on punitive measures.

By adopting a balanced approach, the U.S. can address legitimate grievances while avoiding unnecessary collateral damage. After all, fostering stability and prosperity requires collaboration, not conflict.

### **Conclusion: Weighing the Pros and Cons**

Donald Trump’s idea of applying a 10% tax on Chinese imports is undeniably provocative. Whether it serves as a “trump card” or a risky gamble depends largely on execution and timing. On one hand, it underscores the need for accountability and fairness in international trade. On the other hand, it risks inflaming tensions and triggering unintended consequences.

As the debate unfolds, policymakers must carefully weigh the pros and cons of such a drastic measure. The stakes are high—not just for the U.S. and China but for the entire global community. Ultimately, finding common ground and pursuing constructive dialogue may prove more effective than wielding a “trump card” that could backfire spectacularly.

In conclusion, while Trump’s proposal highlights important issues, it also serves as a reminder of the complexities inherent in managing U.S.-China relations. Navigating this delicate balance will require wisdom, patience, and a commitment to shared goals. Only then can we hope to build a future where competition coexists with cooperation, benefiting all parties involved.