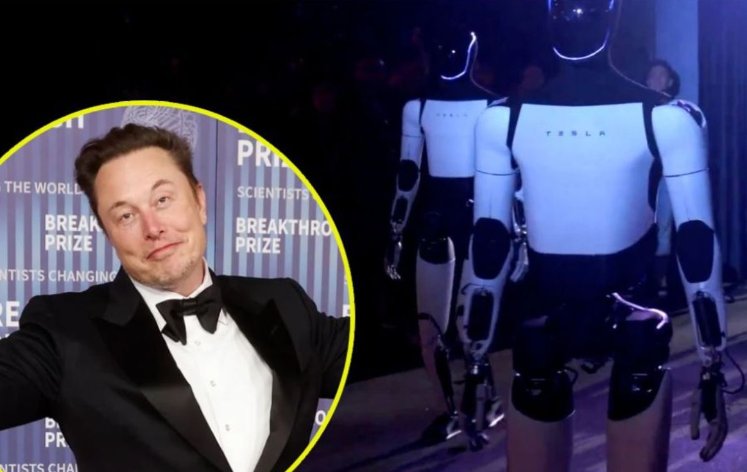

Elon Musk, the maverick billionaire behind Tesla and SpaceX, is no stranger to making bold statements that stir up the markets. Recently, his comment claiming that “everyone on Earth wants to own a Muskbot” has caused a stir, leading to a massive $70 billion drop in Tesla’s valuation. The statement, which Musk made in a public interview, sparked confusion and concern among investors, raising questions about his vision for Tesla’s future and the company’s current market outlook.

Tesla, the electric vehicle giant, has seen dramatic swings in its stock price over the years, often tied to Musk’s provocative remarks and high-risk business strategies. However, this latest comment seems to have struck a chord, causing significant volatility in Tesla’s stock price. Here’s a deeper look at the events leading to this dramatic drop in valuation and what it might mean for the future of both Musk and Tesla.

### The Muskbot Controversy: What Did Elon Musk Mean?

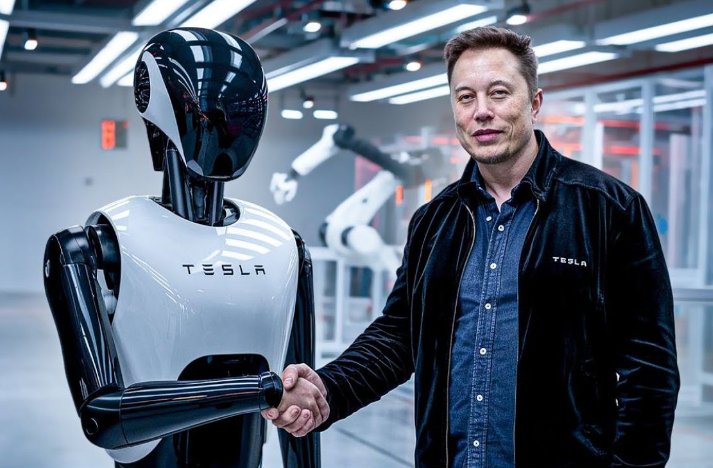

Elon Musk’s statement, “everyone on Earth wants to own a Muskbot,” immediately sparked confusion and speculation. The term “Muskbot” appears to refer to a potential new technology that Musk is envisioning, possibly an advanced AI-driven robot or autonomous system. While details remain vague, the comment hints at Musk’s aspirations for a future in which robotics and artificial intelligence play a central role in Tesla’s product lineup.

However, investors and analysts were left wondering whether this bold claim was a sales pitch for a future product or just another example of Musk’s penchant for ambitious, far-reaching statements. Musk’s companies, including Tesla and SpaceX, are known for pushing the boundaries of innovation, but some market observers feared that this comment might be an indication of the company veering too far off course from its core mission of electric vehicle production.

### Tesla’s Market Reaction: A $70 Billion Drop

After Musk’s comment about the Muskbot, Tesla’s stock price saw a sharp decline, resulting in a staggering $70 billion drop in its market valuation. This sudden drop highlights how sensitive Tesla’s stock is to Musk’s public statements. Investors are well aware that Musk has the power to influence the market, but they are also keenly aware that his unorthodox approach can sometimes cause unforeseen consequences.

For Tesla, the drop in valuation raises questions about the company’s future direction. While Tesla has long been at the forefront of the electric vehicle revolution, its valuation is heavily tied to investor sentiment and Musk’s ability to deliver on ambitious promises. With this latest comment, Musk’s words seem to have rattled investor confidence, at least in the short term.

### The Broader Impact on Tesla’s Stock and Reputation

Tesla has experienced periods of dramatic stock price fluctuations, often triggered by Musk’s tweets, public statements, or bold business ventures. This latest episode adds to a growing narrative that Tesla’s stock price is particularly volatile and susceptible to shifts in Musk’s public persona.

While some investors view Musk’s visionary approach as a key driver of Tesla’s success, others are increasingly concerned about the long-term stability of the company. Tesla’s market performance relies on Musk’s ability to balance ambition with execution, and moments like this one, where speculation outweighs substance, raise doubts about the company’s long-term trajectory.

It’s also important to consider that Tesla’s core business — producing electric vehicles — faces intense competition from traditional automakers and other tech companies entering the EV space. As more players enter the market, Tesla’s position could be tested, especially if Musk’s attention is diverted to projects like the “Muskbot” instead of focusing on Tesla’s primary mission of transforming the automotive industry.

### Musk’s Reputation: Bold Visionary or Reckless Leader?

Elon Musk has long been seen as one of the most visionary figures of our time, known for his bold, sometimes controversial statements and his willingness to take risks that other CEOs would shy away from. His success with Tesla, SpaceX, and other ventures has earned him a reputation as a transformative entrepreneur. However, with this latest comment, some critics are questioning whether Musk’s ambitious persona is becoming a liability for Tesla.

While Musk’s ability to captivate the public’s imagination has helped Tesla become one of the most influential companies in the world, there are growing concerns that his personal brand could be overshadowing the company’s actual business operations. Investors may be wondering if Musk’s focus on projects like the “Muskbot” could divert attention from Tesla’s core mission and the need to maintain leadership in the highly competitive EV market.

Moreover, Musk’s comments often generate headlines, but they also raise the stakes for the companies he leads. When bold predictions or ideas fail to materialize, the consequences are felt in the stock market and investor sentiment. Musk’s track record of turning ambitious ideas into reality is remarkable, but the uncertainty surrounding new ventures like the “Muskbot” could test investors’ patience.

### What’s Next for Tesla and Musk?

Despite the short-term market reaction, it’s important to consider that Tesla and Elon Musk have weathered similar storms in the past. The company’s stock has experienced significant dips in the past only to rebound stronger than ever, thanks to Musk’s vision and the company’s innovative products.

As for the “Muskbot,” it remains to be seen whether this concept will ever come to fruition. Musk is known for pursuing groundbreaking ideas, and his ventures into AI and robotics could open up entirely new markets. However, until more concrete details emerge, the comment about Muskbot will remain speculative, leaving investors uncertain about how it will fit into Tesla’s larger strategy.

In the meantime, Tesla’s focus on electric vehicles, renewable energy, and autonomous driving technology will likely continue to be its primary growth driver. Musk’s ability to bring the world’s attention to emerging technologies remains one of his greatest strengths, but investors may be hoping that he refocuses his attention on delivering results in Tesla’s core business rather than chasing after new, unproven concepts.

### A Volatile Future Ahead for Tesla

Elon Musk’s claim that “everyone on Earth wants to own a Muskbot” may have caused a temporary market shock, but it’s clear that Musk’s bold approach to business will continue to make waves. Tesla’s valuation drop of $70 billion serves as a reminder of how closely the company’s performance is tied to Musk’s persona and his ability to manage both innovation and investor expectations.

While the future of the “Muskbot” remains uncertain, one thing is clear: Tesla’s journey is far from predictable. Whether this latest market dip is a short-term setback or a signal of deeper issues within Tesla, only time will tell. As always, investors will be watching closely to see how Musk navigates this latest challenge and whether his long-term vision for Tesla — and his other ventures — can deliver the results his loyal followers have come to expect.