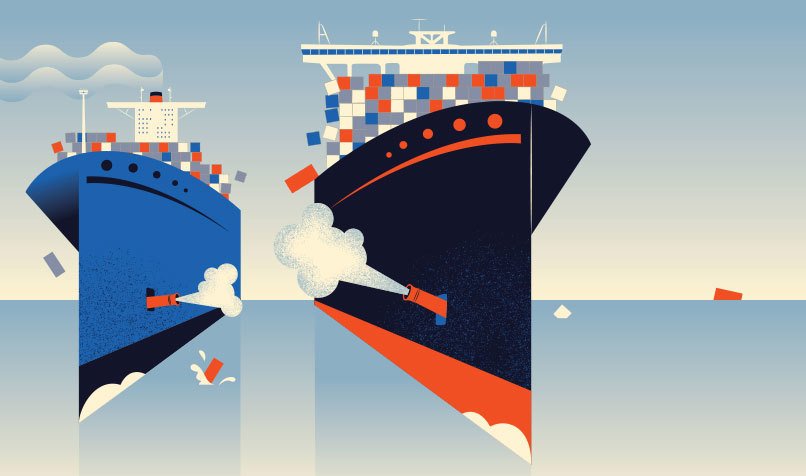

The global trade landscape is once again witnessing a **high-stakes economic battle** as **Canada and China impose retaliatory tariffs on the United States**. This move comes in response to U.S. trade policies, escalating tensions and raising concerns over the **impact on global markets, businesses, and consumers**.

With **billions of dollars at stake**, the consequences of these tariffs are far-reaching. In this article, we’ll break down:

✅ Why Canada and China are imposing these tariffs.

✅ The specific industries affected.

✅ The potential consequences for global trade.

✅ What happens next in this escalating economic war.

## 🔥 The Root of the Conflict – Why Are Tariffs Being Imposed?

Trade disputes are nothing new, but the latest wave of tariffs between the U.S., **Canada**, and **China** stems from ongoing economic and political disagreements.

### 🇺🇸 **U.S. Trade Policies Spark Retaliation**

The U.S. has **recently imposed tariffs** on **key imports from both China and Canada**, citing reasons such as:

– **Unfair trade practices**

– **Intellectual property concerns** (in China’s case)

– **Protection of domestic industries** (steel, aluminum, and agriculture)

However, **Canada and China view these tariffs as economic aggression**, forcing them to strike back with **countermeasures**.

### 🇨🇦 **Canada’s Response – Protecting Its Economy**

Canada, one of the U.S.’s largest trading partners, has been hit hard by U.S. tariffs on **steel and aluminum**. In response, Canada has:

✅ **Imposed retaliatory tariffs on U.S. goods** including dairy products, whiskey, and industrial materials.

✅ Targeted states that are **key to U.S. exports**, putting pressure on American businesses.

✅ Strengthened trade ties with **European and Asian markets** to reduce reliance on the U.S.

### 🇨🇳 **China Strikes Back – The Trade War Intensifies**

China, already engaged in **a long-standing trade war with the U.S.**, has responded with:

✅ **Tariffs on American agricultural products** (soybeans, pork, and corn).

✅ **Higher import duties on U.S. technology and manufacturing goods**.

✅ **Increased economic partnerships** with other nations to counterbalance trade losses.

These moves signal a **wider strategy** by China to reduce dependence on American imports and establish **new trade alliances**.

## 🏭📉 Industries Feeling the Impact

The ripple effect of these retaliatory tariffs is **hitting multiple industries** across all three nations.

### 🚜 **Agriculture – American Farmers Under Pressure**

– China’s tariffs on **soybeans and pork** are directly impacting **U.S. farmers**, many of whom rely on exports to China.

– Canada’s import taxes on **dairy and meat** are also making it harder for American farmers to compete.

– Prices for **food and agricultural goods are rising**, affecting consumers globally.

### 🏗️ **Steel & Manufacturing – Job Market Uncertainty**

– **U.S. steel and aluminum tariffs** have hurt Canadian producers, leading to **job losses and higher prices**.

– In response, Canada’s tariffs on **U.S. industrial materials** are making **American products more expensive**.

– **China’s restrictions on tech imports** are putting pressure on U.S. technology firms.

### 🥃 **Consumer Goods – Higher Prices for Everyone**

– Products like **whiskey, electronics, and household goods** are now **more expensive** due to increased import duties.

– Consumers in **all three countries** are seeing **rising costs** on everyday items.

– Businesses that rely on cross-border trade are **facing supply chain disruptions**.

These industries are at the **center of the trade war**, and their struggles could **impact economic growth** in the coming years.

## 🌍 **Global Economic Consequences – What’s Next?**

As the U.S., Canada, and China **continue their trade battle**, the global economy is feeling the strain.

### 📈 **Stock Market Volatility**

Trade wars create **uncertainty**, leading to **fluctuations in stock markets worldwide**. Investors are closely watching developments, as **economic instability** could lead to **financial losses**.

### 🏦 **Rising Costs & Inflation**

With **higher tariffs on essential goods**, the **cost of living is rising**. This could lead to:

– **Higher inflation rates.**

– **Lower consumer spending.**

– **Potential economic slowdowns.**

### 🤝 **New Trade Alliances Forming**

As tensions rise, countries are **looking for new trade partners** to minimize losses.

– **China is expanding ties with Europe, Africa, and Latin America** to replace lost U.S. exports.

– **Canada is strengthening economic deals with the EU and Asia** to reduce reliance on American trade.

– **The U.S. is seeking to renegotiate agreements**, but uncertainty remains.

## ⚖️ **How Can This Trade War End?**

There are several possible outcomes to this **ongoing economic battle**:

✅ **Negotiations & New Trade Deals** – The most favorable outcome would be **compromises between all nations**, leading to **reduced tariffs and better trade agreements**.

✅ **Long-Term Economic Shifts** – If the trade war continues, businesses and industries may **adapt by changing suppliers and markets**, permanently altering **global trade patterns**.

✅ **Further Escalation** – If neither side backs down, **additional tariffs could be introduced**, leading to **greater economic uncertainty** and **potential recession risks**.

With tensions running high, **government decisions in the coming months will determine the future of global trade**.

## 🎯 **Final Thoughts – Who Wins & Who Loses?**

🌍 **The trade war between the U.S., Canada, and China is having significant economic consequences.**

✅ **Canada is protecting its industries** but facing **rising costs**.

✅ **China is retaliating strategically**, seeking **new trade allies**.

✅ **The U.S. is trying to dominate trade** but facing **backlash from key partners**.

The outcome remains **uncertain**, but one thing is clear: **businesses, workers, and consumers worldwide are feeling the impact.**

💬 **What do YOU think about this trade war? Should countries negotiate or continue imposing tariffs? Let us know in the comments**