Elon Musk, the billionaire entrepreneur and CEO of Tesla, has long been a polarizing figure. Revered for his visionary ideas and groundbreaking innovations, he is equally criticized for his controversial statements and unconventional leadership style. However, recent months have seen a dramatic shift in public sentiment toward Musk, culminating in what many are calling an “anti-Musk wave” sweeping across America. This growing backlash has had severe financial repercussions, with Tesla losing a staggering $358 billion in market value in February alone. In this article, we’ll explore the factors fueling this anti-Musk sentiment, analyze its impact on Tesla’s stock performance, and assess what this means for the future of one of the world’s most iconic electric vehicle companies.

### The Rise of the Anti-Musk Sentiment

Elon Musk’s influence extends far beyond Tesla—he’s a cultural icon whose actions and opinions shape global conversations. However, his high-profile decisions and public behavior have increasingly drawn criticism. From controversial tweets to erratic management decisions, Musk’s actions have alienated segments of the public, investors, and even Tesla loyalists.

In recent months, several key incidents have fueled the growing anti-Musk wave:

**Controversial Social Media Presence** : Musk’s acquisition of Twitter (now X) and his subsequent changes to the platform have sparked widespread backlash. Critics accuse him of prioritizing free speech at the expense of content moderation, leading to concerns about misinformation and toxic discourse.

**Leadership Distractions** : Musk’s focus on managing multiple ventures—including SpaceX, Neuralink, and X—has raised questions about his ability to dedicate sufficient attention to Tesla. Investors worry that his divided focus could hinder Tesla’s growth and innovation.

**Workplace Controversies** : Allegations of poor working conditions and labor disputes at Tesla factories have tarnished the company’s reputation. Critics argue that Musk’s cost-cutting measures and emphasis on efficiency come at the expense of employee welfare.

**Market Skepticism** : As competition in the electric vehicle (EV) space intensifies, some analysts believe Tesla is losing its edge. Musk’s tendency to make bold claims about Tesla’s capabilities—often without immediate results—has led to skepticism among investors.

These factors have combined to create a perfect storm of negative sentiment, resulting in a significant erosion of trust in both Musk and Tesla.

### Tesla’s Staggering Loss: What Happened in February?

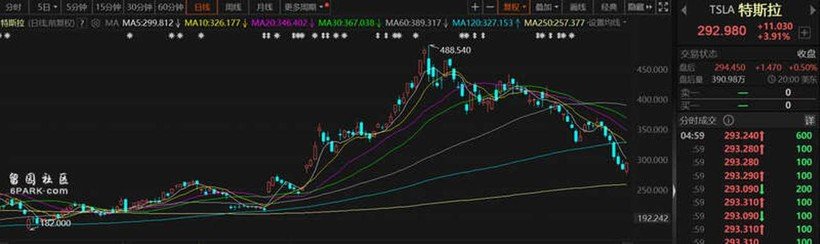

In February, Tesla experienced one of the most dramatic declines in its history, with its market value plummeting by $358 billion. This unprecedented drop sent shockwaves through the financial world and raised serious questions about the company’s future. Several key factors contributed to this collapse:

**Declining Investor Confidence** :

Investors have grown wary of Musk’s leadership style and its potential impact on Tesla’s long-term prospects. Concerns about his ability to balance multiple ventures while steering Tesla effectively have led to a loss of confidence.

**Intensifying Competition** :

Tesla once dominated the EV market, but new players like Ford, General Motors, and Chinese manufacturers such as BYD are rapidly closing the gap. These competitors are offering innovative models with competitive pricing, eating into Tesla’s market share.

**Economic Uncertainty** :

Broader economic challenges, including rising interest rates and fears of a recession, have weighed heavily on tech stocks. Tesla, which relies heavily on future growth projections, has been disproportionately affected by these macroeconomic trends.

**Missed Expectations** :

Tesla’s quarterly earnings report in early 2024 failed to meet Wall Street expectations, further exacerbating investor concerns. Lower-than-expected profit margins and sluggish sales in key markets added to the downward pressure on the stock.

The combination of internal challenges and external pressures created a perfect storm, causing Tesla’s valuation to nosedive in record time.

### The Ripple Effects of the Anti-Musk Wave

The anti-Musk sentiment sweeping America isn’t just affecting Tesla—it’s reshaping perceptions of Musk’s entire empire. Here’s how this wave is impacting various aspects of his businesses and public image:

**Tesla’s Brand Image** :

Once synonymous with innovation and sustainability, Tesla’s brand is now facing scrutiny. Negative headlines about Musk’s leadership and workplace controversies have dented consumer trust, potentially impacting sales.

**X (formerly Twitter)** :

Musk’s overhaul of X has alienated advertisers and users alike, leading to a decline in revenue and engagement. Critics argue that his hands-on approach has destabilized the platform, further eroding his credibility.

**SpaceX and Other Ventures** :

While SpaceX remains a leader in space exploration, some analysts worry that Musk’s controversies could spill over and affect investor confidence in his other ventures.

**Public Perception** :

Musk’s approval ratings have plummeted among certain demographics, particularly younger consumers who prioritize ethical leadership and corporate responsibility. This shift could have long-term implications for his businesses.

### Can Tesla Recover from This Crisis?

Despite the challenges, Tesla still holds significant advantages that could help it recover from this crisis. Here’s what the company can do to regain momentum:

**Focus on Innovation** :

Tesla must continue to lead in EV technology, introducing cutting-edge features and expanding its product lineup. Innovations in battery technology, autonomous driving, and renewable energy solutions will be critical to maintaining its competitive edge.

**Improve Public Relations** :

Addressing workplace controversies and improving transparency could help rebuild trust with employees, customers, and investors. A proactive PR strategy may also counteract negative narratives surrounding Musk.

**Strengthen Leadership** :

Delegating more responsibilities to trusted executives within Tesla could alleviate concerns about Musk’s divided focus. Empowering capable leaders to manage day-to-day operations might restore investor confidence.

**Expand Market Reach** :

Entering emerging markets and offering affordable EV options could help Tesla regain lost ground. Expanding production capacity and streamlining supply chains will also be essential for meeting global demand.

While recovery won’t happen overnight, Tesla’s strong foundation and loyal customer base provide a solid starting point for turning things around.

### Lessons from the Anti-Musk Wave

The anti-Musk wave serves as a cautionary tale about the risks of overexposure and mismanagement in today’s hyper-connected world. Here are some key takeaways:

**The Importance of Reputation Management** :

Public perception plays a crucial role in shaping a company’s success. Leaders must carefully consider the impact of their actions and statements on their brand’s image.

**Balancing Vision with Accountability** :

While bold visions are essential for innovation, they must be backed by tangible results. Overpromising and underdelivering can erode trust and damage long-term prospects.

**Adapting to Changing Markets** :

Companies must remain agile and responsive to shifting consumer preferences and competitive landscapes. Failure to adapt can result in lost opportunities and declining market share.

**The Power of Public Sentiment** :

In an era of social media and instant communication, public opinion can make or break a business. Leaders must engage constructively with stakeholders to maintain goodwill.

### Navigating the Storm

The anti-Musk wave sweeping America highlights the fragility of even the most successful brands and leaders. Tesla’s staggering $358 billion loss in February underscores the consequences of failing to address public concerns and adapt to changing dynamics. However, the story is far from over. With its technological prowess and dedicated fanbase, Tesla has the potential to weather this storm and emerge stronger than ever.

For Elon Musk, the challenge lies in balancing his visionary ambitions with the practical demands of leadership. Whether he can navigate this crisis and restore faith in his empire remains to be seen. One thing is certain: the decisions made in the coming months will shape not only Tesla’s future but also Musk’s legacy as one of the most influential figures of our time. Stay tuned—the next chapter promises to be as unpredictable as the man himself.