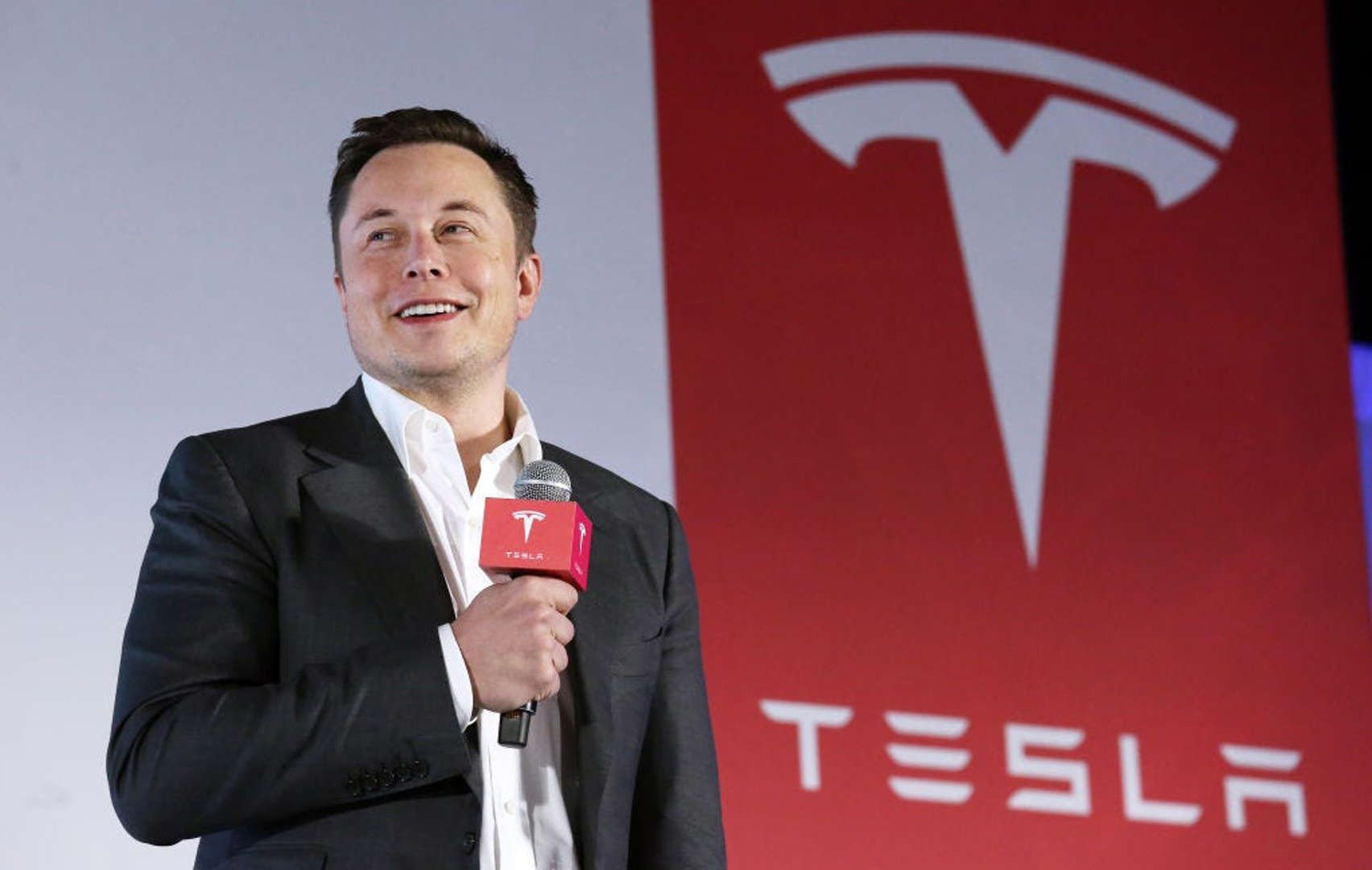

Tesla, the electric vehicle giant, is facing a significant crisis as investors increasingly demand that Elon Musk step down as CEO. The growing pressure stems from concerns that Musk’s leadership style and controversial actions are negatively impacting the company’s reputation, stock performance, and long-term stability. With increasing scrutiny from shareholders and market analysts, Tesla finds itself at a critical crossroads, balancing innovation with the need for more conventional corporate governance.

## **Mounting Investor Concerns**

Investors have become increasingly vocal about their dissatisfaction with Musk’s leadership. While Tesla remains a dominant force in the EV market, recent controversies surrounding Musk have led to concerns that his actions are tarnishing the company’s brand. Shareholders argue that his frequent social media outbursts, erratic decision-making, and focus on ventures outside Tesla, such as SpaceX and X (formerly Twitter), are distracting him from effectively leading Tesla.

Beyond Musk’s external ventures, internal concerns regarding Tesla’s management structure and strategic direction have also surfaced. Some investors argue that Musk’s hands-off approach in critical operational matters has led to inefficiencies, supply chain issues, and an inconsistent corporate culture. Many have called for a leader who is more focused on Tesla’s core business, ensuring long-term sustainability and steady growth.

## **Reputation at Stake**

Tesla’s reputation has long been tied to Musk’s visionary approach and ability to push technological boundaries. However, recent developments have caused investors to worry that his actions are creating a negative perception of the brand. Musk’s public disputes with regulators, provocative statements, and unfiltered social media presence have led to criticism that he is harming Tesla’s credibility. Additionally, his involvement in polarizing political and social debates has further alienated certain customer demographics and investors.

The perception of Tesla as a forward-thinking, sustainable, and innovative company is increasingly overshadowed by Musk’s personal controversies. This has led to concerns that the brand’s association with his persona may be limiting its appeal to environmentally conscious consumers, institutional investors, and mainstream buyers who prefer a more stable and neutral corporate image.

## **Financial Performance and Market Volatility**

Tesla’s stock has experienced significant volatility in recent years, partly due to Musk’s unpredictable behavior. While Tesla remains profitable and continues to expand globally, analysts note that Musk’s actions contribute to market instability. Investors fear that his controversial image could deter institutional investors and impact consumer confidence, leading to potential financial setbacks. As a result, some stakeholders believe that a change in leadership could bring more stability to Tesla’s future growth.

Despite Tesla’s strong financial fundamentals, including revenue growth and increasing vehicle production, the company’s stock performance has been inconsistent. Market analysts suggest that Musk’s high-profile distractions and controversial statements have caused unnecessary turbulence, making Tesla a riskier investment for both long-term and short-term stakeholders. Furthermore, concerns about production costs, supply chain challenges, and competition from other automakers have added to the pressure facing Tesla’s leadership.

## **Calls for a New Leadership Approach**

Many investors believe that Tesla needs a CEO who can focus exclusively on the company’s core business. While Musk’s contributions to Tesla’s success are undeniable, critics argue that a more disciplined and business-focused leader could enhance operational efficiency and investor confidence. Potential replacements with extensive experience in the automotive industry or technology sector are being considered as possible successors if Musk were to step down.

Some experts suggest that Tesla should follow the example of other tech giants, such as Apple and Microsoft, by appointing a professional executive to manage day-to-day operations while allowing Musk to remain in an advisory or innovation-focused role. This would enable Tesla to retain Musk’s visionary leadership while mitigating the risks associated with his high-profile controversies.

## **Regulatory and Legal Challenges**

In addition to investor concerns, Tesla is also facing increasing regulatory scrutiny. Musk’s public feuds with government agencies, including the Securities and Exchange Commission (SEC) and the National Highway Traffic Safety Administration (NHTSA), have raised alarms about potential legal and compliance risks. Tesla’s approach to self-driving technology, labor practices, and environmental regulations has drawn criticism, leading to further concerns that Musk’s leadership may invite unnecessary regulatory battles.

Recent lawsuits and investigations have placed Tesla under a microscope, with critics arguing that the company needs a more conventional CEO to navigate these challenges. Regulatory compliance and legal stability are crucial factors for maintaining investor confidence and ensuring Tesla’s long-term success in a highly competitive industry.

## **Musk’s Response and Future Outlook**

Elon Musk has dismissed calls for his resignation, arguing that Tesla’s innovation and success are directly tied to his leadership. He maintains that his unorthodox approach has been instrumental in making Tesla a global leader in electric vehicles and renewable energy. However, pressure from investors continues to mount, and it remains uncertain whether Tesla’s board will take action in response to shareholder concerns.

Musk has also pointed out Tesla’s strong market position, highlighting the company’s advances in battery technology, AI-driven autonomous driving, and energy solutions. He insists that his leadership is essential for maintaining Tesla’s innovative edge and warns that a shift in leadership could slow down Tesla’s progress.

## **Conclusion**

As Tesla navigates this crisis, the debate over Musk’s leadership will likely continue to shape the company’s trajectory. While his vision and influence have played a pivotal role in Tesla’s rise, the growing demand for stability and accountability may push the company toward significant changes. Whether Musk remains at the helm or Tesla undergoes a leadership transition, the coming months will be crucial in determining the company’s future direction.

Ultimately, Tesla’s ability to balance innovation with strong corporate governance will be key to its long-term success. Investors, customers, and regulators will all be watching closely to see how Tesla responds to this leadership crisis and whether Musk can adapt to the evolving expectations of a publicly traded, globally influential company.