In recent weeks, a growing chorus of American billionaires has voiced their concern over the upcoming implementation of the reciprocal tax proposed by former President Donald Trump. These elite figures from various industries—including technology, finance, retail, and manufacturing—have urged Mr. Trump to postpone the enforcement of the reciprocal tax for at least 90 days. This call has not only stirred discussions in the corridors of Washington but also ignited debates across global markets. With major economic implications at stake, the billionaires argue that a delay is essential to protect American investments, secure global trade relationships, and allow businesses the time to adapt strategically.

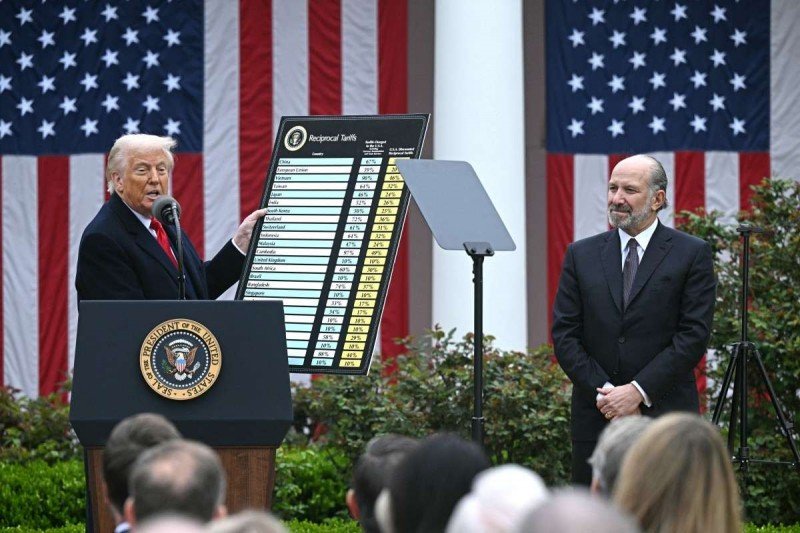

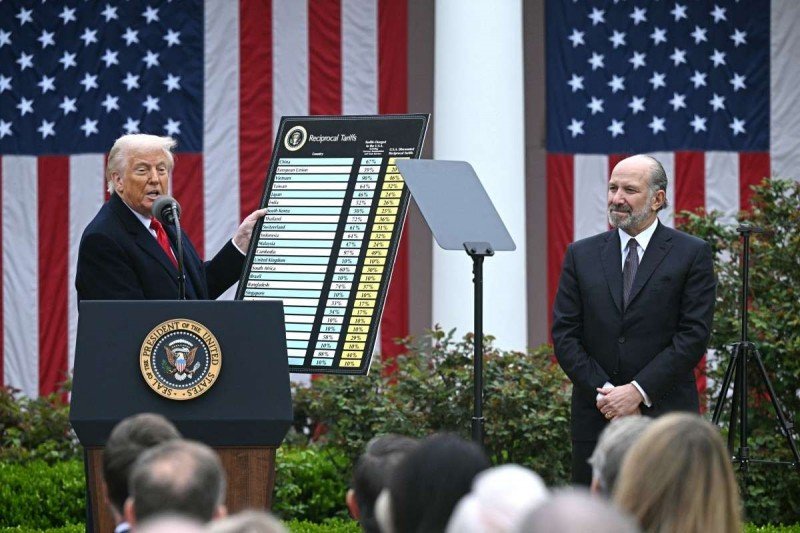

**Understanding the Reciprocal Tax Plan**

The concept of a reciprocal tax has long been part of Trump’s economic rhetoric. The idea is simple in theory but complex in practice: if a foreign country imposes a tax or tariff on American exports, the U.S. should impose an equivalent tax on that country’s goods and services entering the U.S. market. While proponents argue this fosters fair trade, critics suggest it may spiral into retaliatory measures and trade wars.

As the 2024 presidential campaign heats up, Mr. Trump has revived the reciprocal tax proposal as a core part of his platform, promising to bring fairness to international trade. However, the sudden timeline for implementation has raised red flags among many of the country’s wealthiest and most influential economic players.

**Billionaire Business Leaders Speak Out**

Leading American billionaires, including tech moguls, hedge fund managers, real estate tycoons, and industrial magnates, have reportedly signed an open letter to Mr. Trump. Among the signatories are names rumored to include Elon Musk, Warren Buffett, Jamie Dimon, and Jeff Bezos. Although not all names have been publicly confirmed, the message is clear: rushing the reciprocal tax without ample preparation may wreak havoc on an already fragile global economic environment.

In the letter, these billionaires collectively argue that while they support the broader goal of balanced trade, they believe that the current global market conditions demand caution. They highlight existing supply chain disruptions, inflationary pressures, and geopolitical tensions as reasons why a sudden tax policy shift could be detrimental.

**The Economic Risks of Immediate Implementation**

The main argument made by the billionaires revolves around the unpredictability of introducing such a sweeping policy in the short term. The reciprocal tax, if implemented immediately, could lead to:

1. **Disruption of Global Supply Chains:** Many American businesses rely heavily on imported components and raw materials. A new reciprocal tax could increase costs and slow down production.

2. **Price Hikes for Consumers:** Higher tariffs mean higher prices. From electronics to food products, everyday Americans could bear the brunt of this policy.

3. **Retaliatory Measures:** Other nations may not take the reciprocal tax lightly. This could result in retaliatory tariffs, potentially harming American exporters and further escalating trade tensions.

4. **Stock Market Volatility:** Markets thrive on predictability. Sudden shifts in trade policy often lead to investor panic and market downturns.

**Why 90 Days Matters**

The billionaires are not asking Mr. Trump to scrap the reciprocal tax altogether. Instead, they are requesting a 90-day postponement. This grace period would allow:

– Businesses to re-evaluate supply chain strategies.

– Economists and policy experts to run impact assessments.

– Lawmakers to hold public hearings and gather stakeholder feedback.

– Global partners to engage in diplomatic discussions to mitigate friction.

In essence, the billionaires believe that a calculated delay could help avoid an economic knee-jerk reaction and pave the way for a smoother transition.

**Trump’s Response: Standing Firm or Flexing Strategy?**

While Mr. Trump has yet to issue an official response, insiders from his campaign suggest that he remains committed to leveling the global trade playing field. However, Trump is also known for his transactional approach to politics. If the call for postponement gains enough momentum—especially from influential donors and economic advisors—he may consider adjustments to the timeline.

It’s worth noting that Trump has historically responded to pressure from the business community, especially when it aligns with broader economic interests. During his previous presidency, he delayed certain tariff measures after backlash from farmers, manufacturers, and retailers.

**The Political Chessboard: 2024 Elections and Trade Policy**

Trade policy will likely play a critical role in the 2024 presidential election. Trump’s America First economic agenda resonates with a significant portion of his base, particularly in the Midwest and industrial heartlands. The idea of imposing taxes on foreign goods appeals to voters who feel America has been treated unfairly on the global stage.

However, Trump must also balance this populist rhetoric with the practical concerns of the business elite—many of whom are campaign donors and influencers of economic policy. The request to postpone the reciprocal tax could be a litmus test for how Trump manages competing interests heading into the election.

**What This Means for Small and Medium Businesses**

While billionaires are leading the charge, the impact of the reciprocal tax will be felt most acutely by small and medium-sized enterprises (SMEs). Many of these businesses operate on thin margins and depend on affordable imported goods to stay competitive.

A 90-day delay would give SMEs a critical window to adjust sourcing contracts, renegotiate prices, and communicate changes to customers. Without this period, many small businesses fear they will be caught off guard, leading to layoffs, lost revenue, or even closures.

**Global Reactions: Allies and Adversaries Watching Closely**

The world is watching America’s next move. Key trading partners—including the European Union, China, Mexico, and Canada—have all expressed concern about the potential fallout of the reciprocal tax. These nations are preparing their own contingency plans, which could include retaliatory tariffs on American goods like automobiles, agricultural products, and energy exports.

Diplomatic envoys have been quietly urging Washington to reconsider or at least delay the measure. If Trump heeds the billionaires’ advice, it could also signal to international allies that the U.S. remains open to negotiation, not confrontation.

**Media and Public Opinion: A Divided Landscape**

The media coverage of this issue reflects America’s broader political divide. Conservative outlets generally support the reciprocal tax, viewing it as a long-overdue corrective to decades of trade imbalances. Meanwhile, centrist and liberal media emphasize the potential risks to the economy, especially if the tax is implemented too hastily.

Public opinion remains split. Some Americans welcome the idea of putting America first, even if it means temporary price hikes. Others are worried about job losses and economic instability. The billionaires’ call for a delay adds another layer to the conversation, reframing the issue not as anti-American, but as pro-stability and pro-business.

**Historical Parallels and Lessons Learned**

Economists have drawn parallels between Trump’s reciprocal tax plan and past protectionist policies, such as the Smoot-Hawley Tariff Act of 1930, which many believe deepened the Great Depression. While the global economy today is more interconnected and resilient, history offers a cautionary tale about the unintended consequences of aggressive trade restrictions.

The billionaires urging a delay seem to understand this context. They argue not against reform, but against rash action that could echo past economic missteps.

**Looking Ahead: Will Trump Bend or Hold the Line?**

As the pressure mounts, Trump faces a critical decision. Will he stand firm on his timeline and risk economic backlash? Or will he heed the advice of some of America’s most successful entrepreneurs and financiers and delay the policy for strategic reasons?

The next few weeks may prove pivotal—not just for Trump’s campaign, but for the future of American trade and the global economic balance.

**Conclusion: A Call for Patience, Not Opposition**

The call from America’s billionaires to delay the reciprocal tax is not an act of defiance against the Trump doctrine. Rather, it is a strategic appeal for caution, preparation, and foresight. In the high-stakes arena of global trade, timing is everything. A 90-day pause could make the difference between a smooth policy rollout and a disruptive economic storm.

As the world watches and waits, one thing is certain: the voices of these billionaires have amplified the conversation, ensuring that the debate around reciprocal taxes is no longer just political—but profoundly economic.