Tesla has been a pioneer in the electric vehicle (EV) market, capturing the attention of investors, consumers, and the media alike. However, in a shocking turn of events, the company has experienced a massive 36% drop in just one quarter, resulting in a staggering $460 billion in losses. This rapid decline raises questions about Tesla’s future and what it means for the broader market. Beyond the numbers, Tesla’s fall serves as a cautionary tale for investors, signaling potential instability in a market that has become synonymous with rapid growth and volatility.

**Tesla’s Massive Drop: What Happened?**

In the span of just three months, Tesla’s stock has plunged by 36%, erasing an eye-watering $460 billion in market value. Once considered the crown jewel of the electric vehicle industry, Tesla now finds itself grappling with significant losses that have sent shockwaves through the stock market. The decline marks a dramatic shift in the narrative surrounding Tesla, which has been regarded as one of the most valuable and innovative companies in the world.

So, what caused this dramatic drop? Several factors have contributed to Tesla’s decline, and they paint a picture of a company facing significant challenges:

1. **Intensifying Competition:** As more automakers enter the electric vehicle market, Tesla is no longer the only game in town. Companies like Rivian, Lucid Motors, and established automakers such as Ford and General Motors are ramping up their EV production, which has led to increased competition for Tesla.

2. **Production and Supply Chain Issues:** Tesla, like many other manufacturers, has struggled with supply chain disruptions and production delays. These issues have slowed down the company’s ability to meet its ambitious growth targets and affected its bottom line.

3. **Market Volatility:** The stock market has been volatile in recent months, with inflation concerns, interest rate hikes, and global economic instability putting pressure on many stocks, including Tesla’s. Investor sentiment has shifted, and many are questioning whether Tesla’s lofty valuation is sustainable in such an unpredictable economic environment.

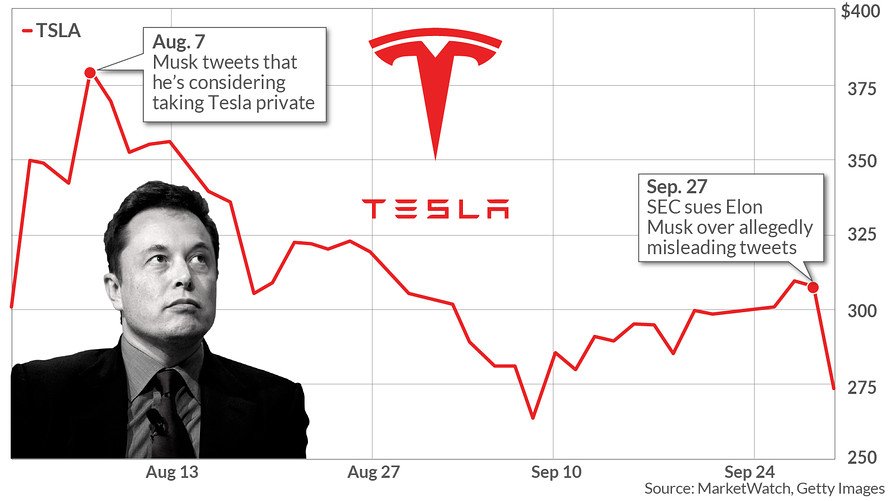

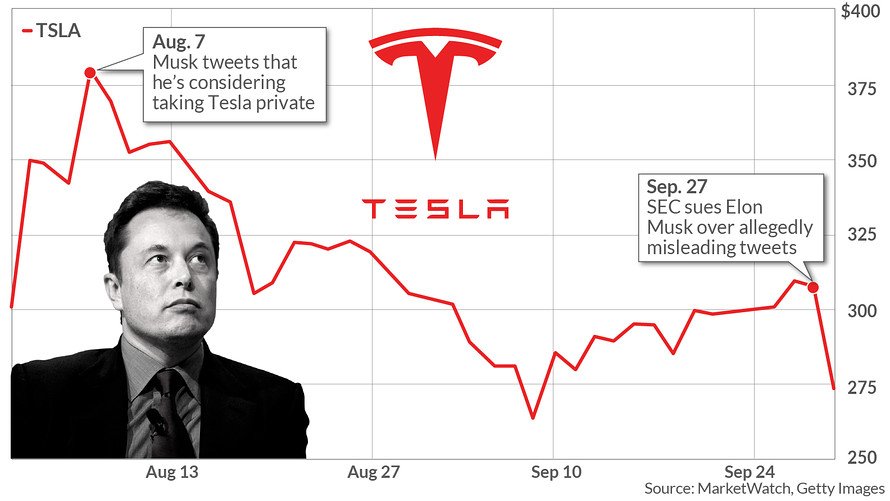

4. **Leadership and Strategy Questions:** Tesla’s CEO, Elon Musk, has become a polarizing figure, and his focus on ventures outside of Tesla, such as SpaceX and Twitter, has raised concerns about his ability to lead the company effectively. Additionally, some analysts are questioning the long-term viability of Tesla’s business model as it faces increasing scrutiny over its profitability and competition.

**What Does $460 Billion Vanishing Mean for Tesla and the Market?**

The loss of $460 billion is more than just a number – it represents the evaporating confidence of investors who once believed that Tesla was on an unstoppable path to dominance. For many, Tesla’s meteoric rise to a trillion-dollar company seemed like the future of transportation. Now, with this massive decline, the market is forced to reassess Tesla’s prospects.

Tesla’s fall is a wake-up call for investors who have grown accustomed to the idea that the EV revolution is inevitable and that Tesla would lead the charge. While Tesla still holds a dominant position in the electric vehicle market, its future is no longer certain. This uncertainty has led to a broader market sell-off, with investors scrambling to adjust their portfolios in response to the shifting landscape.

**A Cautionary Tale for Investors**

Tesla’s sharp decline serves as a stark reminder that no company is immune to market forces, no matter how innovative or successful it may seem in the short term. For investors, this is a warning sign that relying too heavily on one stock or industry can be risky, especially when that industry is still in its infancy.

It also underscores the volatility of the tech and EV sectors, where hype and excitement can drive stock prices to unsustainable heights, only to fall back to earth when reality sets in. While Tesla remains a major player in the EV market, its recent struggles highlight the risks that come with investing in growth companies, particularly those with high valuations.

**What’s Next for Tesla?**

Looking ahead, the question remains: Can Tesla recover from this dramatic drop, or is this the beginning of a longer-term downturn? While it’s too early to predict the company’s future with certainty, there are several key factors that will determine Tesla’s path forward:

1. **Innovation and New Models:** Tesla must continue to innovate and expand its product lineup to stay ahead of the competition. New models, improvements in battery technology, and advancements in autonomous driving will be crucial in maintaining its market leadership.

2. **Managing Supply Chain and Production Challenges:** Overcoming supply chain issues and streamlining production will be essential for Tesla’s recovery. If the company can ramp up production and meet demand efficiently, it may be able to regain investor confidence.

3. **Market Conditions and Investor Sentiment:** Ultimately, Tesla’s future will depend on broader market conditions and investor sentiment. If the global economy stabilizes and investors become more confident in the company’s long-term prospects, Tesla could see a rebound. However, if economic instability continues, Tesla may face further challenges.

**A Market in Flux**

Tesla’s 36% drop and the disappearance of $460 billion in market value is a reminder that the road to success for any company is not always smooth. For investors, it serves as a warning that markets can change quickly, and past performance is not always an indicator of future success. As the EV industry continues to evolve and competition intensifies, Tesla will need to adapt to the changing market dynamics to stay relevant.

For now, the fall of Tesla is a cautionary tale—a reminder that even the most disruptive companies can face major setbacks. Whether Tesla can bounce back remains to be seen, but one thing is certain: the market will be watching closely.