Nvidia, the tech giant that has dominated the AI and semiconductor industry, recently hit an astonishing $3 trillion market capitalization. However, in a surprising turn of events, the company has now fallen below this historic milestone. What caused this sudden shift? Is this a temporary setback, or does it signal deeper challenges for the company? Let’s dive into the factors behind Nvidia’s market cap fluctuation and what it means for investors.

—

## **Nvidia’s Meteoric Rise to $3 Trillion** 📈🚀

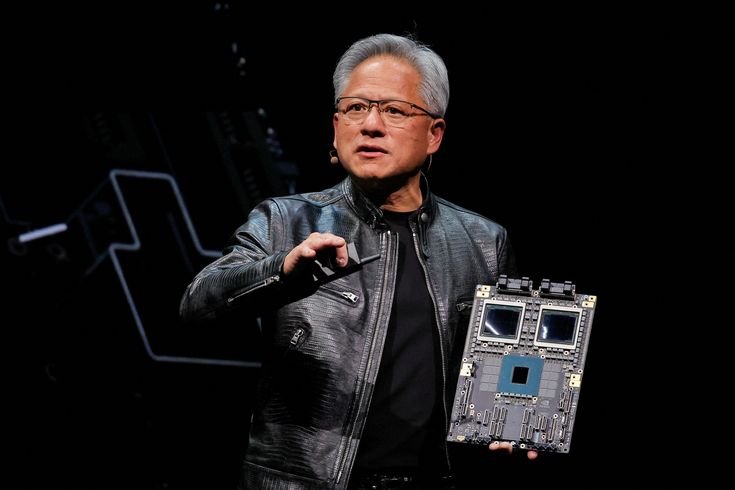

Nvidia’s journey to a $3 trillion valuation was nothing short of spectacular. The company’s dominance in artificial intelligence (AI), data centers, and gaming GPUs fueled its rapid growth. Several key factors contributed to its rise:

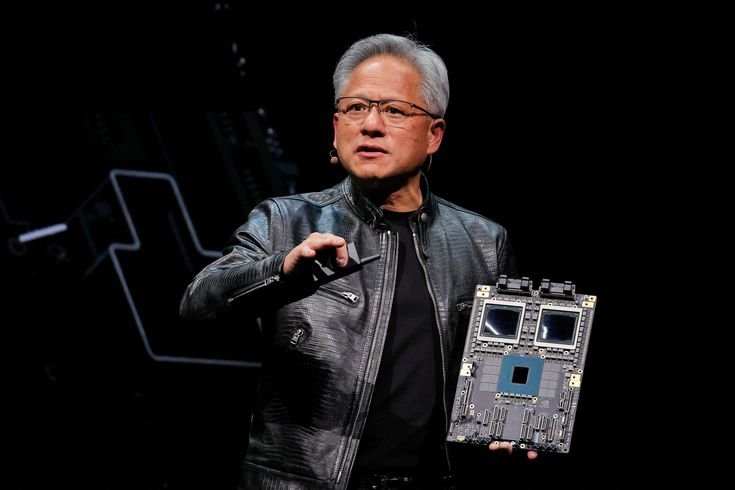

✔ **AI Boom & Demand for GPUs** 🤖💡: Nvidia’s AI-focused chips, such as the H100, have become the backbone of AI model training and machine learning, making the company a leader in the AI revolution.

✔ **Cloud & Data Center Expansion** ☁️🏢: Tech giants like Google, Microsoft, and Amazon rely on Nvidia’s GPUs to power their AI-driven cloud computing services.

✔ **Stock Market Rally & Investor Confidence** 📊💰: Investors rushed to buy Nvidia shares, betting on the long-term potential of AI and its growing role in various industries.

✔ **Strategic Partnerships & Innovation** 🔬🤝: Nvidia’s continuous advancements in AI, robotics, and gaming technology cemented its position as an industry leader.

Reaching a $3 trillion market cap put Nvidia in an exclusive club alongside Apple and Microsoft, but the company couldn’t hold onto this valuation for long. What happened next?

—

## **Why Did Nvidia’s Market Cap Drop?** 📉😨

Despite its success, Nvidia faced several challenges that led to its market capitalization dipping below $3 trillion. Here are the key reasons:

### **1. Profit-Taking by Investors** 💸📊

After Nvidia’s stock skyrocketed, many investors decided to **lock in profits**, leading to a wave of sell-offs. This is a common occurrence after a stock reaches record highs, as traders capitalize on gains before potential volatility.

### **2. Market Volatility & Economic Uncertainty** 📉🌍

Global economic conditions, interest rate concerns, and overall market corrections have affected even the strongest stocks. Tech stocks, in particular, are vulnerable to market sentiment and external factors, leading to fluctuations in share prices.

### **3. Increased Competition in the AI Space** 🤖⚔️

While Nvidia remains the industry leader in AI chips, competition is intensifying. Companies like AMD, Intel, and even tech giants like Google and Amazon are developing their own AI-focused chips, threatening Nvidia’s market dominance.

### **4. Supply Chain & Manufacturing Concerns** 🏭⚠️

Despite Nvidia’s technological prowess, the company still relies on global chip manufacturers like TSMC. Any disruptions in the supply chain, semiconductor shortages, or geopolitical tensions could impact production and revenue growth.

### **5. Regulatory & Government Scrutiny** 🏛️🚨

Governments worldwide are paying close attention to the semiconductor industry due to its strategic importance. Regulations, export restrictions, and antitrust scrutiny could pose challenges for Nvidia’s future expansion, particularly in international markets.

—

## **What’s Next for Nvidia?** 🔮📊

Despite the recent dip, Nvidia remains a powerhouse in the AI and semiconductor industry. Analysts and investors are closely watching how the company will navigate these challenges and continue its growth trajectory.

### **Potential Catalysts for a Comeback:**

✅ **AI & Data Center Growth**: Continued demand for AI-powered solutions and data center expansion will drive Nvidia’s revenue in the long run. ✅ **New Product Launches**: Upcoming GPU releases and innovations in AI hardware will be crucial in maintaining Nvidia’s edge over competitors. ✅ **Strategic Acquisitions & Partnerships**: Nvidia’s ability to acquire or partner with key tech players could strengthen its market position. ✅ **Stock Buybacks & Financial Strategies**: The company might implement stock buyback programs or financial strategies to regain investor confidence.

—

## **Final Thoughts: Is Nvidia Still a Strong Investment?** 🤔💰

While Nvidia’s dip below $3 trillion might seem alarming, it is a natural part of the stock market’s ebb and flow. The company remains at the forefront of AI and semiconductor innovation, making it a strong contender for long-term growth.

However, investors should stay informed about **market trends, competition, and regulatory developments** before making investment decisions. Will Nvidia bounce back and reclaim its $3 trillion status—or even surpass it? Only time will tell ⏳🚀

📢 **What are your thoughts on Nvidia’s future? Drop your predictions in the comments below** 👇💬