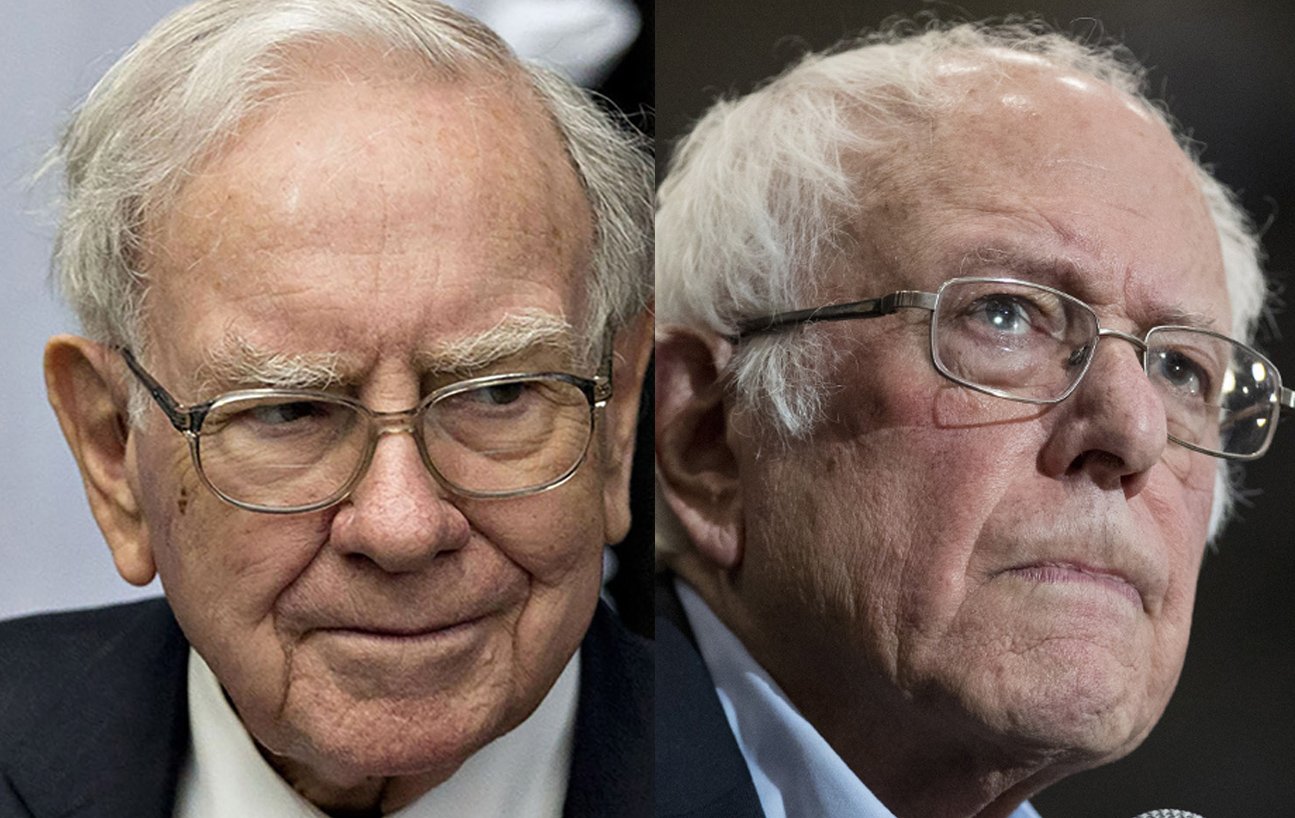

Warren Buffett, one of the most renowned investors in the world, has never been one to shy away from speaking his mind on matters of economic policy. In a recent interview, Buffett didn’t hold back in his criticism of President Donald Trump’s controversial tariffs, which he describes as disastrous for the U.S. economy. According to the Oracle of Omaha, Trump’s tariffs will not only crash the economy but also lead to higher prices for American consumers.

### The Tariffs: A Recipe for Economic Disaster

In his interview with CBS, Warren Buffett slammed Trump’s tariffs, specifically the 25% tariff on goods from Canada and Mexico and the doubling of tariffs on Chinese products to 20%. Buffett argued that these tariffs are essentially a “tax on goods,” and emphasized that consumers would bear the brunt of the financial burden.

“The tooth fairy doesn’t pay them,” Buffett quipped, pointing out that the costs associated with tariffs are not absorbed by foreign countries but passed directly to American consumers. In other words, the tariffs are not a magical solution to trade imbalances, but a costly burden that will lead to higher prices for everyday goods.

Buffett’s warning resonates with many economists who have long argued that tariffs—while they may offer short-term protection for specific industries—ultimately harm the broader economy. With the U.S. already facing uncertainty in global trade relationships, these tariffs could cause long-lasting damage to the nation’s financial stability.

### The Economic Consequences: A Market in Free Fall

As Buffett pointed out, the economic fallout from these tariffs is already beginning to show. The markets reacted swiftly, with the Dow Jones Industrial Average plummeting nearly 650 points following the announcement of the new tariffs. Both the S&P 500 and Nasdaq experienced significant losses as well, reflecting growing investor concerns about the long-term impact of Trump’s trade policies.

Buffett warned that tariffs would stifle economic growth, creating instability and uncertainty that would shake investor confidence. The Oracle of Omaha is known for his long-term investment strategies, and his concern is clear: tariffs disrupt the global supply chain, leading to higher production costs and reduced trade volumes. This, in turn, negatively impacts the overall economy, ultimately making it more difficult for businesses to thrive and for consumers to enjoy affordable goods.

### Higher Prices for Consumers: A Burden on the Middle Class

One of the most concerning aspects of Trump’s tariffs, according to Buffett, is the impact they will have on American consumers. With tariffs driving up the cost of imported goods, the everyday shopper will feel the pinch in their wallets. From groceries to electronics, no product is immune to price hikes. And while some may argue that the tariffs are designed to protect American industries, Buffett emphasizes that the real victims are consumers who will face higher prices across the board.

For many, this translates to a significant financial burden. Middle-class families, in particular, will find themselves paying more for everyday goods while receiving little in return. Buffett’s warning serves as a stark reminder of the negative consequences of protectionist policies that prioritize short-term political gains over long-term economic stability.

### A Blow to America’s Reputation as a Stable Trading Partner

In addition to the economic damage, Buffett also expressed concern about the long-term damage these tariffs could cause to America’s reputation on the world stage. By imposing arbitrary and punitive tariffs, the U.S. risks losing its standing as a stable and reliable trading partner. Other countries, including Canada, Mexico, and China, may retaliate with their own tariffs, further escalating trade tensions and eroding trust in the American economy.

Buffett’s remarks reflect the broader sentiment among global leaders and economists who warn that these tariffs will lead to a breakdown in international trade relationships. If left unchecked, the U.S. could find itself isolated from the global economy, facing higher prices and diminished access to foreign markets.

### The Political Implications: Divisions in the Republican Party

The fallout from Trump’s tariffs extends beyond the economy and into the political realm. While the president’s supporters—particularly those in the Republican Party—have hailed the tariffs as a necessary step to protect American industries, Buffett’s comments suggest that these policies may be more harmful than helpful.

For many Republican voters, the promise of lower prices and economic prosperity has proven to be an illusion. Instead of benefiting from cheaper goods, American consumers are now faced with higher costs as a direct result of Trump’s tariffs. Buffett’s criticism highlights the political and economic divisions that have emerged within the Republican Party, as many are beginning to question whether the trade policies championed by Trump are truly in the best interests of the American people.

### The Economic Risk of Trump’s Tariffs

Warren Buffett’s sharp critique of President Trump’s tariffs is a wake-up call for both policymakers and the American public. While the president may view these tariffs as a means of protecting American industries, Buffett and other economists warn that the long-term consequences could be catastrophic for the U.S. economy. Higher prices, market instability, and a diminished reputation as a global trading partner are just some of the dangers that lie ahead if these policies are allowed to continue unchecked.

As Buffett put it, “The tooth fairy doesn’t pay them.” The reality is that American consumers will pay the price for these misguided tariffs, and the damage to the economy could take years to repair. It’s time for a more thoughtful approach to trade policy—one that prioritizes long-term stability and prosperity over short-term political victories.