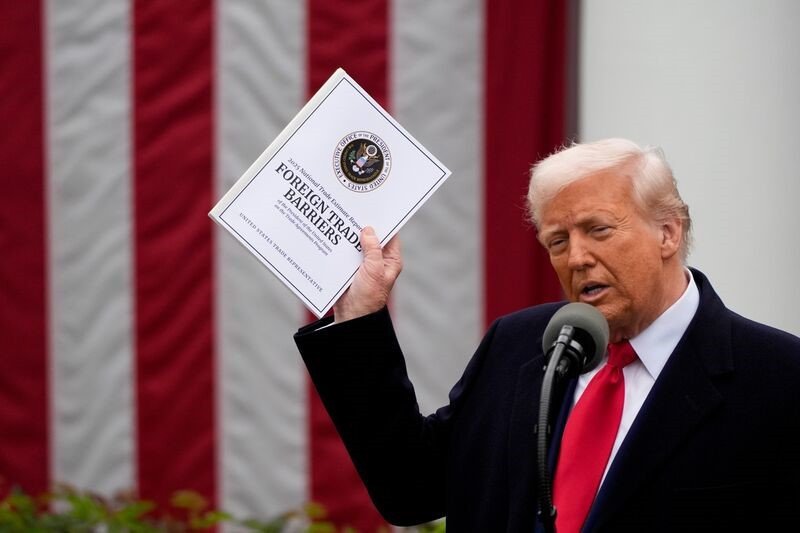

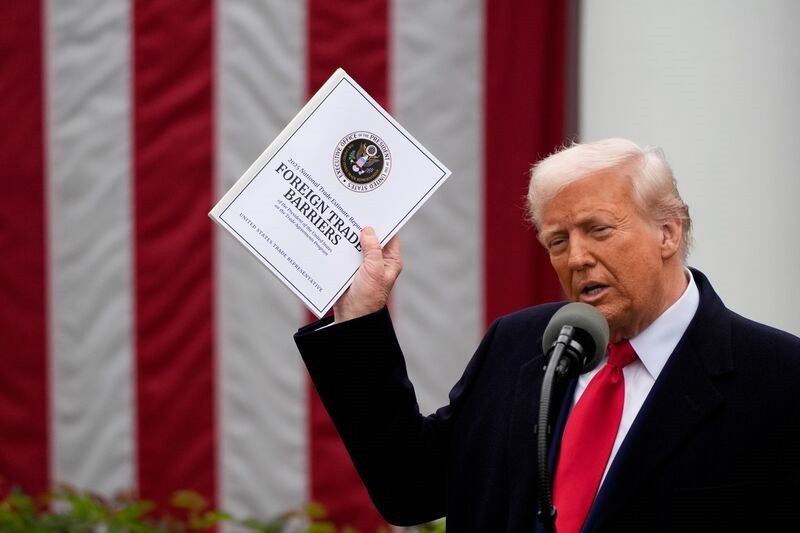

The global financial markets have been thrown into turmoil following a massive tax decision by former U.S. President Donald Trump. This unprecedented move has triggered uncertainty among investors, businesses, and economic experts worldwide. Market volatility has soared as analysts attempt to assess the full impact of this tax policy on global trade, investment flows, and economic stability.

### The Tax Policy and Its Key Provisions

Trump’s tax reform, which has been widely debated, focuses on significant corporate tax cuts, deregulation, and incentives aimed at repatriating offshore capital. The key provisions include:

– A drastic reduction in corporate tax rates from 35% to 21%

– Elimination of certain tax deductions and loopholes

– New tariffs on foreign imports, leading to concerns about trade wars

– A one-time repatriation tax to encourage multinational corporations to bring profits back to the U.S.

### Immediate Market Reactions

Global stock markets experienced sharp declines as investors reacted to the uncertainty surrounding the tax policy.

– **U.S. Markets:** The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all saw significant drops, erasing gains accumulated over months.

– **European Markets:** Major indices such as the FTSE 100, DAX, and CAC 40 plummeted as fears of reduced foreign investment loomed.

– **Asian Markets:** The Shanghai Composite, Nikkei 225, and Hang Seng Index suffered losses as concerns over trade disruptions escalated.

### Impact on Global Trade and Economic Growth

Trump’s tax policy has raised alarms over the future of international trade and economic relations. Several global economies now face potential disruptions due to:

– **Trade War Risks:** The imposition of tariffs on imports has provoked retaliation from major trading partners such as China, the European Union, and Canada.

– **Investment Uncertainty:** Foreign investors are reassessing their commitments to the U.S. market, given the unpredictable regulatory environment.

– **Currency Fluctuations:** The U.S. dollar has strengthened, causing emerging market currencies to depreciate, further destabilizing global markets.

### Corporate Reactions and Business Sentiment

Multinational corporations have expressed mixed reactions to the tax policy changes.

– **Positive Impact:** Some U.S.-based firms, particularly in technology and manufacturing, have welcomed the lower corporate tax rates.

– **Negative Impact:** Foreign companies operating in the U.S. fear increased operational costs and potential retaliatory measures from their home countries.

– **Stock Buybacks vs. Wage Growth:** Critics argue that many corporations are using tax savings for stock buybacks rather than increasing wages or expanding operations.

### Effects on Emerging Markets

Developing economies have been hit hard by the ripple effects of Trump’s tax decision.

– **Capital Flight:** Investors are pulling funds from emerging markets, leading to a liquidity crisis.

– **Debt Concerns:** Countries with significant U.S. dollar-denominated debt are struggling with increased repayment costs.

– **Inflationary Pressures:** Higher costs of imported goods are fueling inflation in emerging economies, affecting consumers and businesses alike.

### Long-Term Economic and Political Consequences

The broader implications of Trump’s tax blow extend beyond financial markets and into economic policy debates worldwide.

– **Shift in Global Tax Policies:** Other nations may be forced to reconsider their tax structures to remain competitive.

– **Political Backlash:** Rising inequality and corporate favoritism may lead to political instability and social unrest.

– **U.S. Fiscal Deficit Growth:** The substantial tax cuts have raised concerns over ballooning government debt and potential future economic slowdowns.

### Conclusion

Trump’s tax policy has sent shockwaves through the global financial markets, sparking concerns over trade wars, investment shifts, and economic uncertainty. While some businesses stand to gain, others are bracing for increased volatility and financial stress. The long-term implications remain uncertain, but one thing is clear: the world economy is in for a turbulent ride. Investors, policymakers, and businesses must navigate these challenges carefully to mitigate potential risks and capitalize on emerging opportunities.