In the 21st century, rare earth elements (REEs) have become essential components in the global race for technological and military supremacy. These 17 chemically similar elements are critical to the production of high-tech devices, renewable energy systems, electric vehicles, and advanced defense technologies. As the demand for these materials continues to surge, the global battle for control over rare earth supply chains has intensified.

Once a dominant player in the rare earth market, the United States now finds itself falling behind China, which has solidified its position as the world’s leading producer and processor of rare earth elements. This strategic imbalance raises serious concerns over national security, economic independence, and technological competitiveness.

### China’s Dominance in the Rare Earth Industry

China currently controls more than 60% of global rare earth production and nearly 90% of rare earth refining. Over the past two decades, Beijing has strategically invested in its rare earth sector, prioritizing both extraction and processing capabilities. These efforts have given China an unparalleled advantage in the global supply chain.

While the U.S. possesses significant rare earth reserves, it has failed to build out a complete domestic supply chain. Most notably, the U.S. lacks sufficient rare earth refining and separation infrastructure, forcing it to send mined materials overseas—often to China—for processing. This dependency leaves the U.S. vulnerable to supply disruptions and political leverage.

### Historical Context: From Leader to Laggard

Ironically, the United States was once a global leader in rare earth mining. During the 1980s, California’s Mountain Pass mine was the world’s top producer of REEs. However, due to lax environmental regulations and lower production costs in China, the U.S. industry declined, and China quickly filled the void.

By the early 2000s, the U.S. had ceded much of its production capacity. Meanwhile, China continued expanding its influence by investing in downstream capabilities, creating a vertically integrated industry that spans mining, refining, and manufacturing.

### National Security Risks and Technological Vulnerabilities

Rare earths are essential for a range of U.S. defense applications, including guided missiles, fighter jets, and radar systems. According to the U.S. Department of Defense, more than 750 military products depend on rare earth components. This makes China’s grip on the industry a significant threat to American national security.

In 2019, during the height of the U.S.-China trade war, Chinese state media openly suggested that Beijing could use rare earth exports as a weapon. The mere hint of such an embargo caused alarm among U.S. policymakers and underscored the urgent need for a resilient domestic supply chain.

### Why the U.S. is Struggling to Compete

There are several reasons why the U.S. is losing momentum in the rare earth race:

1. **Lack of Refining Infrastructure:** Although the U.S. can mine rare earths, it lacks the necessary refining plants to process the raw materials into usable components.

2. **Environmental Regulations:** Stringent environmental laws in the U.S. make it difficult to develop large-scale mining and processing facilities quickly.

3. **Funding and Investment Gaps:** The private sector has been hesitant to invest in rare earth projects due to high startup costs, market volatility, and long-term uncertainty.

4. **Workforce and Expertise Shortages:** Years of underinvestment have led to a scarcity of skilled workers and technical experts in rare earth production.

5. **Global Competition:** China offers rare earths at artificially low prices due to state subsidies, making it difficult for American companies to compete.

### Government Response: Too Little, Too Late?

Recognizing the risks, the U.S. government has recently ramped up efforts to reduce its dependence on China for rare earths. Initiatives include:

– **Executive Orders:** Former President Trump and current President Biden both signed executive orders aimed at boosting domestic rare earth production.

– **Pentagon Contracts:** The Department of Defense has awarded contracts to companies like MP Materials and Lynas Rare Earths to support U.S.-based processing facilities.

– **Bipartisan Legislation:** Several bills have been introduced in Congress to incentivize rare earth mining, recycling, and research.

Despite these steps, progress remains slow. Many proposed projects are still years away from operation, and bureaucratic hurdles continue to stall development.

### MP Materials and the Mountain Pass Revival

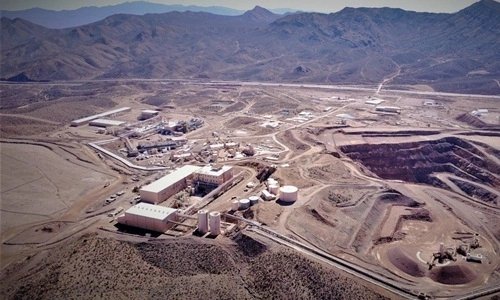

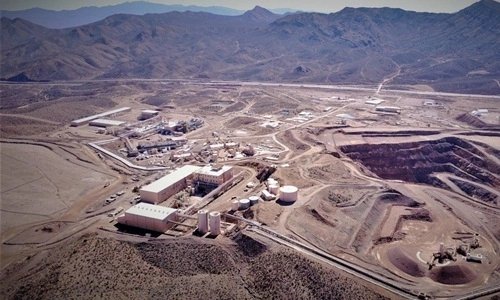

One bright spot in the U.S. rare earth sector is MP Materials, which operates the revived Mountain Pass mine in California. Since its reopening in 2017, the mine has become the largest rare earth operation in the Western Hemisphere.

MP Materials plans to build a domestic refining facility to reduce reliance on China. However, critics note that the company still sends a significant portion of its output to China for processing. Moreover, Chinese investors hold a sizable stake in the firm, raising questions about long-term strategic independence.

### Global Efforts to Diversify Supply Chains

The U.S. is not alone in its attempt to counter China’s dominance. Allied countries such as Australia, Canada, and Japan have also accelerated their rare earth initiatives. Joint ventures and international partnerships are being explored to create an allied rare earth supply chain.

For instance, Australia’s Lynas Rare Earths is developing a processing plant in Texas in collaboration with the U.S. government. Meanwhile, Canada has announced tax incentives for critical mineral projects, and the European Union has launched its own raw materials alliance.

These global efforts highlight a growing consensus: breaking China’s monopoly on rare earths is not just a national priority—it’s a geopolitical imperative.

### The Clock is Ticking: What’s at Stake?

If the U.S. fails to establish a robust rare earth supply chain, the consequences could be severe:

– **Economic Dependence:** Key industries such as electric vehicles, wind energy, and semiconductors may suffer supply shortages and price spikes.

– **Military Vulnerability:** The defense sector could face delays or shutdowns in weapons manufacturing due to component shortages.

– **Loss of Technological Edge:** American innovation could stagnate if the country is unable to access the materials needed for advanced technologies.

– **Global Influence Decline:** Falling behind in critical minerals could erode U.S. leadership in the global tech economy.

### Toward a Sustainable and Secure Rare Earth Future

To regain its footing, the U.S. must pursue a comprehensive and coordinated rare earth strategy that includes:

– **Public-Private Partnerships:** Encourage collaboration between government agencies and private companies to share risks and accelerate development.

– **Environmental Innovation:** Invest in cleaner extraction and processing technologies to meet environmental standards without compromising competitiveness.

– **Recycling and Reuse:** Develop a national rare earth recycling program to reclaim valuable materials from electronic waste.

– **STEM Education and Workforce Development:** Build a pipeline of skilled workers with expertise in mining, metallurgy, and materials science.

– **Strategic Stockpiling:** Establish national reserves of rare earth elements to safeguard against supply shocks.

### Conclusion: Can the U.S. Catch Up?

The rare earth race is more than just a competition for resources—it’s a battle for the future of technology, security, and global leadership. While the U.S. has awakened to the strategic importance of rare earths, it remains years behind China in terms of capacity, infrastructure, and execution.

Catching up will require bold investments, regulatory reform, and long-term vision. The road ahead is challenging, but with the right strategy and international cooperation, the U.S. still has a chance to close the gap and secure its place in the rare earth economy of the future.