Former U.S. President Donald Trump has once again made headlines with his bold economic strategy. In a recent statement, Trump confirmed that smartphones, computers, and other electronic devices will be subject to new import taxes if he returns to office. This declaration has sent shockwaves through the tech industry and raised questions about the future of global trade, inflation, and the accessibility of essential technology products for American consumers.

The proposed tariffs mark a pivotal shift in Trump’s economic agenda, aimed at promoting American manufacturing and reducing reliance on foreign electronics—especially from countries like China. With this announcement, Trump has reignited debates around protectionism, consumer costs, and the broader implications of tariff-based strategies on innovation and economic growth.

**A New Wave of Tariffs: The Core of Trump’s Vision**

At the heart of Trump’s proposal is the imposition of new tariffs on imported consumer electronics—products that Americans use every day. Items such as iPhones, laptops, tablets, smartwatches, and gaming consoles are all likely to be impacted. Trump argues that these new taxes will help protect American jobs and industries by encouraging domestic production.

According to Trump’s team, the aim is to revive the American manufacturing sector by shifting supply chains back to the United States. By making imported electronics more expensive, the administration hopes companies will find it economically advantageous to manufacture devices locally rather than abroad.

Critics argue that this approach could result in higher prices for consumers and may not achieve the desired outcomes, especially given the complexity of electronics manufacturing and the lack of domestic infrastructure in the U.S. to support large-scale production of such products.

**Impact on Consumers: Higher Prices on Everyday Devices**

If the proposed tariffs are implemented, American consumers could face a noticeable increase in the prices of electronic products. Tech giants like Apple, Dell, HP, Samsung, and Lenovo, which rely heavily on overseas production, would likely pass on the additional costs to buyers.

For example, a smartphone that currently costs $1,000 might see a 10-25% price increase, depending on the scale of the tariff. Similarly, laptops and gaming consoles could become significantly more expensive, putting pressure on families and individuals already dealing with inflation and rising living costs.

The move may also impact educational and professional accessibility. Students and remote workers who rely on affordable tech devices may find it harder to upgrade their equipment, potentially widening the digital divide.

**Tech Industry Reacts: Concerns and Strategic Shifts**

The technology industry has voiced strong concerns about Trump’s proposal. Many companies warn that tariffs could disrupt supply chains, limit innovation, and damage global competitiveness. The Consumer Technology Association (CTA) estimates that a 25% tariff on electronics could cost the U.S. economy billions in lost growth and productivity.

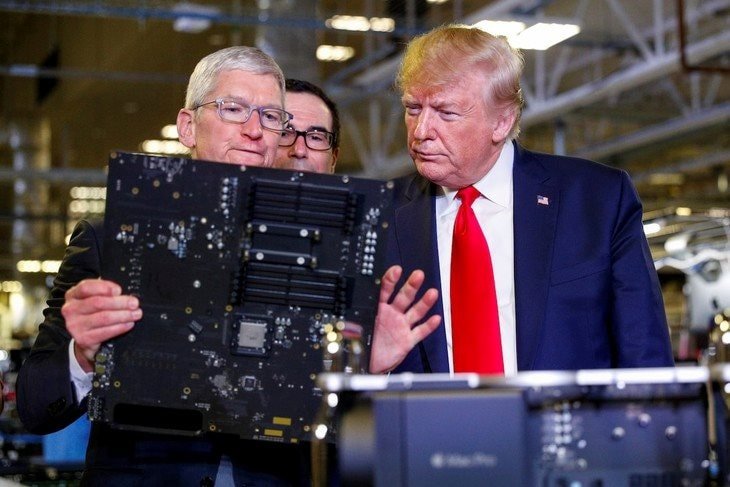

Apple, in particular, could be significantly affected due to its extensive manufacturing presence in China. While the company has already started diversifying its supply chain to countries like India and Vietnam, a full transition to U.S.-based production remains years away and would require massive infrastructure investments.

In response to Trump’s announcement, several companies are reportedly reevaluating their long-term strategies, including diversifying manufacturing locations, exploring automation, and lobbying against the proposed tariffs.

**Global Trade Tensions: China in the Crosshairs**

Trump’s tariff proposal is not just an economic policy—it’s also a geopolitical strategy. By targeting consumer electronics, the former president is doubling down on his longstanding trade tensions with China. During his previous administration, Trump initiated a series of tariffs on Chinese goods, sparking a trade war that rattled global markets.

The new round of taxes appears to continue that trajectory, placing additional pressure on Beijing while signaling a tough stance on intellectual property theft, unfair trade practices, and the outflow of American capital.

China, in turn, has responded with its own tariffs and export restrictions in the past. If Trump’s new tech tariffs are enacted, a tit-for-tat escalation could resume, potentially leading to a full-blown trade war 2.0—this time centered around the technology sector.

**Economic Implications: Inflation, Jobs, and Manufacturing Hopes**

The economic ripple effects of taxing smartphones and computers are complex. On one hand, tariffs could lead to inflationary pressure as consumers absorb higher costs. On the other hand, Trump argues that the policy would incentivize companies to bring back jobs to the U.S., thus strengthening the local economy in the long run.

Economists remain divided. Some believe that the tariffs could disrupt the market, weaken consumer spending, and slow down economic growth. Others agree with Trump’s assessment that bold moves are needed to correct decades of manufacturing decline and trade imbalances.

The success of this strategy depends on whether American industries can scale up to meet demand and whether the job creation would offset the negative impact of higher prices.

**Political Reactions: A Polarizing Proposal**

Trump’s announcement has stirred political debate across party lines. Supporters view the proposal as a courageous plan to protect American sovereignty and economic independence. They argue that dependency on foreign technology is a national security risk and that taxing imports is a legitimate way to level the playing field.

Opponents, however, see it as an economically reckless move. Democrats and some moderate Republicans warn that the tariffs could backfire by hurting American consumers and small businesses. They argue that global cooperation and trade are essential in a connected world and that protectionism risks isolating the U.S. economy.

As the 2024 election cycle heats up, Trump’s tech tariff policy is likely to become a central issue in debates about the future direction of American economic policy.

**Tech Alternatives: Rise of Domestic Startups and Innovation**

If tariffs on foreign electronics are imposed, there may be an unintended consequence: the rise of domestic tech startups. Entrepreneurs and smaller companies may see an opportunity to enter the market by producing affordable electronics within the U.S. or innovating new solutions to meet demand.

This could lead to a renaissance of American innovation, echoing the country’s past leadership in technology during the early computing and semiconductor eras. However, such a transition would require significant investment in R&D, manufacturing capabilities, and workforce training.

Moreover, it raises the question of whether consumers are willing to adopt less mature, less refined products in exchange for supporting local businesses and avoiding tariff-induced price hikes.

**International Response: Allies and Competitors Take Note**

Other countries are watching Trump’s proposal closely. Key U.S. allies, including members of the European Union, Japan, and South Korea, have expressed concern over potential disruptions to global trade norms. Many of these nations are home to leading electronics manufacturers and may face indirect consequences if American demand for foreign tech declines.

At the same time, competitors like India and Vietnam may benefit from Trump’s strategy if companies choose to relocate their production lines to these countries to avoid tariffs. These nations have been actively courting tech investments and may gain leverage in future trade negotiations.

The global electronics market could face significant reshuffling, with power dynamics shifting based on trade barriers and new alliances formed around supply chain resilience.

**Conclusion: A Defining Moment for U.S. Tech Policy**

Mr. Trump’s declaration that smartphones, computers, and electronics will be taxed under his potential future administration represents a dramatic shift in the way the U.S. approaches technology, trade, and economic policy. While his supporters applaud the move as a necessary push for self-reliance, critics warn of the potential consequences: higher consumer costs, trade tensions, and economic uncertainty.

The proposal forces a critical national conversation: Should the U.S. prioritize domestic production even at the cost of short-term economic discomfort? Or should it continue to embrace globalization and international supply chains to maintain affordability and innovation?

As the world prepares for another U.S. presidential election, the tech tariff debate could very well shape the future not only of the American economy but of global trade, consumer electronics, and the digital age itself.