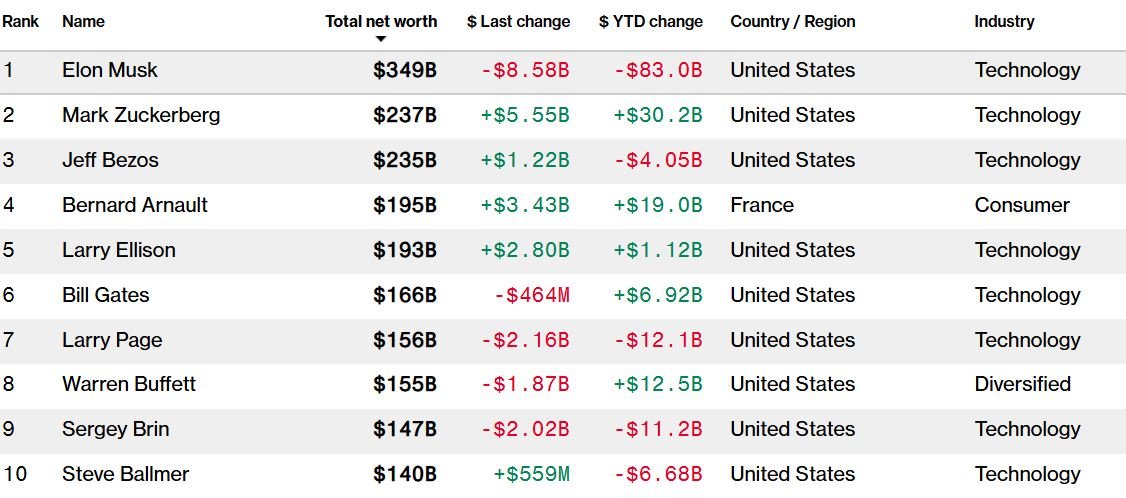

In the volatile world of billionaire wealth, few stories have captured as much attention in recent months as Elon Musk’s staggering financial loss. Since the start of the year, the Tesla and SpaceX CEO has seen his net worth plummet by a jaw-dropping $83 billion, making headlines across global media outlets. While such losses might seem catastrophic for most individuals, they are emblematic of the unique dynamics of ultra-high-net-worth fortunes tied to stock markets and speculative ventures. But what exactly is driving this dramatic decline, and what does it mean for Musk’s empire—and his legacy? Let’s explore the factors behind this monumental drop.

### A Fragile Balance

To understand how Elon Musk could lose $83 billion without selling a single asset, it’s essential to recognize that his fortune is largely paper-based. Unlike traditional wealth measured in cash or tangible assets, Musk’s net worth is primarily derived from his stakes in publicly traded companies like Tesla, SpaceX, and Twitter (now rebranded as X). When these companies’ stock prices fluctuate, so too does his valuation on paper.

Tesla, which accounts for the majority of Musk’s wealth, has experienced significant volatility in 2023. Concerns over slowing electric vehicle demand, increased competition from rivals like Ford and Rivian, and broader macroeconomic challenges have weighed heavily on Tesla’s share price. Additionally, Musk’s controversial leadership style—including his frequent social media outbursts and shifting priorities since acquiring Twitter—has raised doubts among investors about his ability to focus on Tesla’s long-term growth.

SpaceX, though privately held, also contributes to Musk’s valuation through private market assessments. However, any perceived instability in Musk’s public ventures can indirectly affect investor sentiment toward SpaceX, further compounding his financial woes.

The result? A perfect storm of declining stock prices and eroding investor confidence has wiped billions off Musk’s net worth in record time.

### Market Pressures and Economic Uncertainty

Beyond company-specific issues, broader economic trends have played a pivotal role in Musk’s financial downturn. Rising interest rates, inflationary pressures, and geopolitical tensions have created an uncertain environment for global markets. Investors are increasingly cautious, favoring stability over riskier bets—especially when it comes to tech-heavy stocks like Tesla.

Moreover, regulatory scrutiny has intensified around Musk’s businesses. From antitrust investigations into Tesla’s practices to concerns about misinformation on X, Musk faces mounting legal and reputational risks. These external pressures not only impact current valuations but also cast doubt on future profitability, further depressing stock prices.

Another contributing factor is Musk’s own behavior. His unpredictable tweets and high-profile controversies often overshadow positive developments within his companies. For instance, his decision to rename Twitter to X and pivot toward an “everything app” vision has been met with skepticism, alienating advertisers and users alike. Such missteps exacerbate negative perceptions, fueling downward spirals in market performance.

### The Ripple Effect on Musk’s Empire

While $83 billion may sound catastrophic, it’s important to note that Musk remains one of the wealthiest individuals on the planet, with a net worth still estimated at well over $100 billion. However, the ripple effects of this decline extend beyond personal finances. For one, it raises questions about the sustainability of Musk’s ambitious projects, many of which rely on continuous funding and investor support.

Take SpaceX, for example. The company is currently working on groundbreaking initiatives like Starship, designed to transport humans to Mars, and Starlink, a satellite internet service aiming to connect remote areas worldwide. Both ventures require substantial capital investment, and any erosion of trust in Musk’s leadership could jeopardize their progress.

Similarly, Tesla’s expansion plans—such as building new Gigafactories and developing next-generation vehicles—are contingent on maintaining strong investor confidence. If Tesla’s stock continues to struggle, securing financing for these projects could become more challenging, potentially slowing down innovation timelines.

Even X, formerly Twitter, isn’t immune to these challenges. Advertisers have fled the platform amid concerns over content moderation policies, leaving Musk scrambling to find alternative revenue streams. Without a clear path to profitability, X risks becoming a financial drain rather than a valuable addition to Musk’s portfolio.

### Lessons from Musk’s Financial Rollercoaster

Musk’s $83 billion loss offers several critical lessons about the nature of extreme wealth and its vulnerabilities:

#### **Paper Wealth Is Fragile**

Billionaires like Musk derive much of their net worth from stock valuations, which can swing dramatically based on market conditions. This highlights the precariousness of paper wealth compared to liquid assets.

#### **Public Perception Matters**

High-profile figures are constantly under the microscope, and every action—or tweet—can influence investor sentiment. Maintaining a stable public image is crucial for sustaining confidence in business ventures.

#### **Diversification Reduces Risk**

Relying heavily on a single company or industry exposes individuals to significant risks. Diversifying investments across sectors can help mitigate losses during downturns.

#### **Leadership Impacts Value**

Investors place immense value on effective leadership. Controversial decisions or erratic behavior can undermine trust, leading to declines in both stock prices and overall enterprise value.

### What Does the Future Hold for Elon Musk?

Despite the eye-popping figure of $83 billion, Musk’s financial setback doesn’t necessarily spell doom for his enterprises—or his ambitions. History shows that he has weathered similar storms before, using setbacks as opportunities to innovate and adapt. Whether it’s navigating production challenges at Tesla or overcoming technical hurdles with SpaceX, Musk has consistently demonstrated resilience in the face of adversity.

That said, regaining lost ground will require strategic adjustments. Musk must address investor concerns by refocusing on core competencies, improving transparency, and fostering stability within his organizations. Rebuilding relationships with advertisers on X and reaffirming commitment to Tesla’s mission could go a long way in restoring confidence.

Additionally, Musk might consider leveraging his remaining resources to double down on transformative projects. By accelerating advancements in AI, space exploration, and renewable energy, he can reinforce his position as a visionary leader capable of shaping the future.

### A Test of Resilience

Elon Musk’s $83 billion loss serves as a stark reminder of the highs and lows inherent in entrepreneurial success. While the scale of his financial hit is unprecedented, it underscores the interconnectedness of innovation, market forces, and public perception. For Musk, this moment represents both a challenge and an opportunity—to prove once again that he can navigate uncertainty and emerge stronger than ever.

So, what’s behind the staggering drop? It’s a combination of market turbulence, self-inflicted controversies, and systemic risks facing even the most powerful players in the business world. Yet, if history teaches us anything, it’s that Musk thrives under pressure. Whether he can turn this latest chapter into another triumph remains to be seen—but one thing is certain: the world will be watching closely.