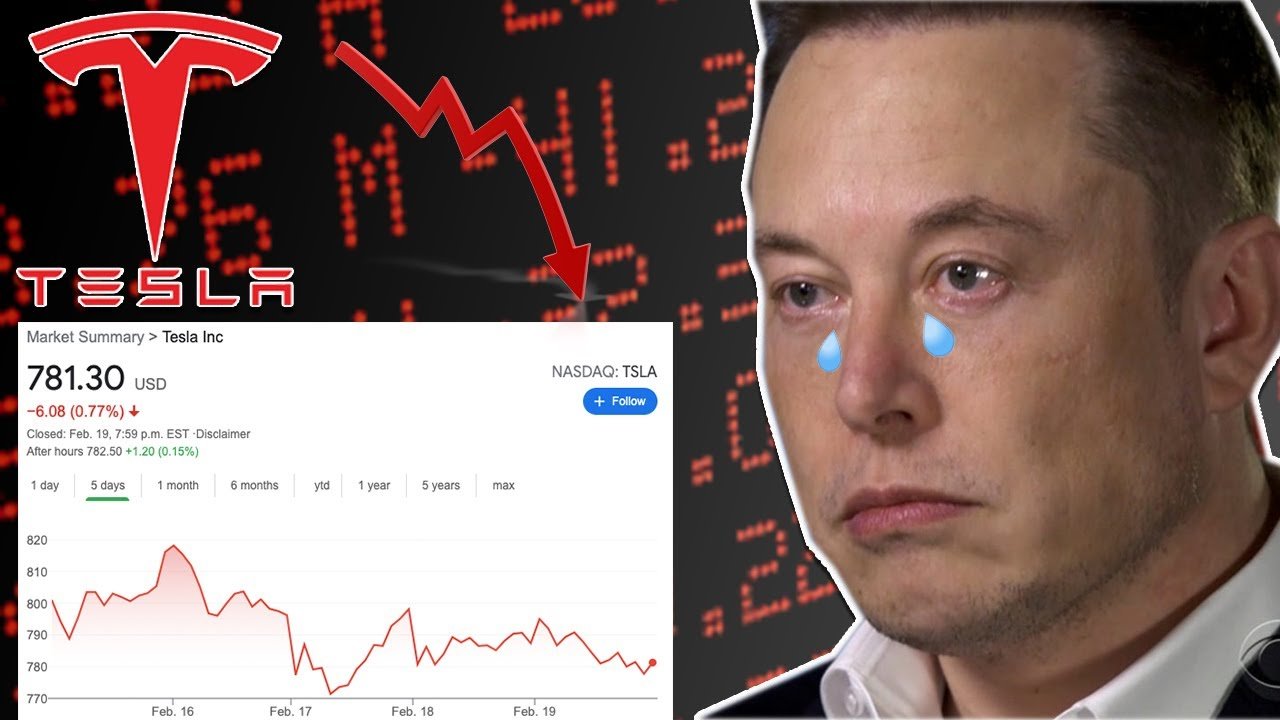

In a dramatic turn of events, Tesla shares have plummeted by 8%, erasing much of the gains seen during the post-election surge. Investors who were optimistic about the electric vehicle giant’s future are now left scrambling to understand what caused this sudden reversal. Was it market overreaction, underlying company challenges, or broader economic factors at play? In this article, we’ll delve into the reasons behind Tesla’s sharp decline and explore what this means for the company—and its shareholders—moving forward.

### **A Brief Recap**

Following the recent U.S. election, Tesla shares experienced a significant uptick, driven by investor optimism surrounding potential policy changes favorable to the electric vehicle (EV) industry. Many analysts predicted that a pro-climate administration would accelerate the transition to renewable energy, boosting demand for EVs and benefiting companies like Tesla. This optimism fueled a rally, with Tesla’s stock price climbing steadily in the days after the election.

However, as quickly as the surge began, it unraveled. Within weeks, Tesla shares tumbled by 8%, leaving investors questioning whether the initial excitement was misplaced or if external forces intervened to disrupt the momentum. To fully grasp this collapse, we must examine both internal and external factors impacting Tesla’s performance.

### **Market Sentiment and Investor Overreaction**

One key factor contributing to Tesla’s recent decline is shifting market sentiment. While the post-election surge was fueled by enthusiasm, it may have been premature. Investors often react strongly to political developments, but these reactions don’t always align with long-term fundamentals. In Tesla’s case, the initial spike in share prices may have been driven more by speculation than tangible improvements in the company’s outlook.

As reality set in, some investors likely realized that policy changes take time to materialize and may not immediately translate into increased sales or profitability for Tesla. This realization prompted a wave of profit-taking, where short-term traders sold off their shares to lock in gains. Such behavior can create a domino effect, causing panic among other investors and accelerating the stock’s decline.

Moreover, Tesla’s valuation has long been a point of contention. Even after the recent drop, the company remains one of the most highly valued automakers globally, despite facing stiff competition and operational challenges. For some investors, the post-election surge pushed Tesla’s stock price beyond reasonable levels, making the subsequent correction almost inevitable.

### **Company-Specific Challenges Facing Tesla**

Beyond broader market dynamics, several company-specific issues have contributed to Tesla’s downturn. These challenges highlight vulnerabilities that could weigh on the stock in the coming months.

#### **Production Delays and Supply Chain Woes**

Tesla has faced ongoing difficulties related to production timelines and supply chain disruptions. The global semiconductor shortage continues to impact automakers, and Tesla is no exception. Delays in manufacturing key models, such as the Model 3 and Model Y, have raised concerns about the company’s ability to meet delivery targets. Any hiccup in production can lead to missed revenue forecasts, which directly impacts investor confidence.

#### **Intensifying Competition in the EV Market**

While Tesla remains a dominant player in the EV space, it is no longer the sole innovator. Traditional automakers like Ford, General Motors, and Volkswagen are aggressively expanding their EV lineups, while startups like Rivian and Lucid Motors are gaining traction. Increased competition puts pressure on Tesla to maintain its edge in technology, pricing, and brand loyalty. Failure to do so could result in lost market share, further dampening investor sentiment.

#### **Elon Musk’s Leadership Controversies**

Elon Musk’s leadership style has always been polarizing, and his recent actions haven’t helped matters. From controversial tweets to high-profile distractions involving SpaceX and Neuralink, Musk’s focus seems divided. Critics argue that his erratic behavior undermines investor trust and creates unnecessary volatility for Tesla’s stock. Additionally, Musk’s frequent selling of Tesla shares to fund ventures like Twitter (now X) has drawn scrutiny, with some fearing he prioritizes personal projects over Tesla’s growth.

### **Broader Economic Factors Impacting Tesla**

Tesla’s struggles cannot be viewed in isolation; they are part of a larger economic context affecting the entire market. Several macroeconomic trends have exacerbated the company’s woes:

#### **Rising Interest Rates**

The Federal Reserve’s efforts to combat inflation through higher interest rates have weighed heavily on growth stocks like Tesla. As borrowing costs rise, investors tend to favor safer assets, such as bonds, over speculative investments. This shift in preference disproportionately affects companies with lofty valuations, including Tesla.

#### **Economic Uncertainty**

Concerns about an impending recession loom large, prompting businesses and consumers alike to tighten their belts. For Tesla, this means reduced consumer spending on big-ticket items like cars. If economic conditions worsen, demand for Tesla vehicles could soften, putting additional strain on the company’s financial performance.

#### **Geopolitical Risks**

Global tensions, particularly between the U.S. and China, pose another risk to Tesla. The company relies heavily on its Shanghai Gigafactory for production and exports. Any escalation in trade disputes or regulatory hurdles in China could disrupt operations and hurt profitability.

### **Analyst Reactions and Future Outlook**

Unsurprisingly, Wall Street analysts are divided on Tesla’s prospects following the 8% drop. Some remain bullish, pointing to the company’s strong brand, innovative technology, and first-mover advantage in the EV market. They argue that short-term setbacks should not overshadow Tesla’s long-term potential.

Others, however, are more cautious. These analysts warn that Tesla’s premium valuation leaves little room for error. Should the company fail to deliver consistent growth or navigate current challenges effectively, further declines could follow. They also emphasize the importance of diversifying revenue streams beyond vehicle sales, such as expanding energy storage solutions and autonomous driving technologies.

For now, all eyes are on Tesla’s upcoming earnings report, which will provide critical insights into the company’s health. Metrics such as production numbers, profit margins, and guidance for future quarters will be closely scrutinized by investors seeking reassurance—or justification for continued caution.

### **What Does This Mean for Investors?**

For existing Tesla shareholders, the recent downturn raises difficult questions. Is this a temporary dip offering an attractive buying opportunity, or a sign of deeper structural problems within the company? Those with a long-term perspective may view the sell-off as a chance to accumulate shares at a discount, betting on Tesla’s eventual recovery. Conversely, risk-averse investors might choose to exit their positions until clearer signs of stability emerge.

Prospective investors face a similar dilemma. While Tesla’s ambitious vision and pioneering role in the EV revolution make it an enticing prospect, the stock’s volatility and lofty valuation require careful consideration. Before jumping in, potential buyers should assess their risk tolerance and conduct thorough due diligence.

### **Navigating Uncertainty**

Tesla’s 8% plunge serves as a stark reminder of the inherent risks in investing in high-growth companies. The unexpected collapse of the post-election surge underscores the importance of balancing optimism with realism when evaluating market trends and corporate performance.

While Tesla remains a leader in the EV industry, it faces formidable challenges—from intensifying competition to macroeconomic headwinds—that cannot be ignored. Whether the company can overcome these obstacles and reclaim its upward trajectory depends on its ability to execute strategically and adapt to changing circumstances.

For now, Tesla’s journey remains unpredictable—but that unpredictability is precisely what makes it such a fascinating stock to watch.